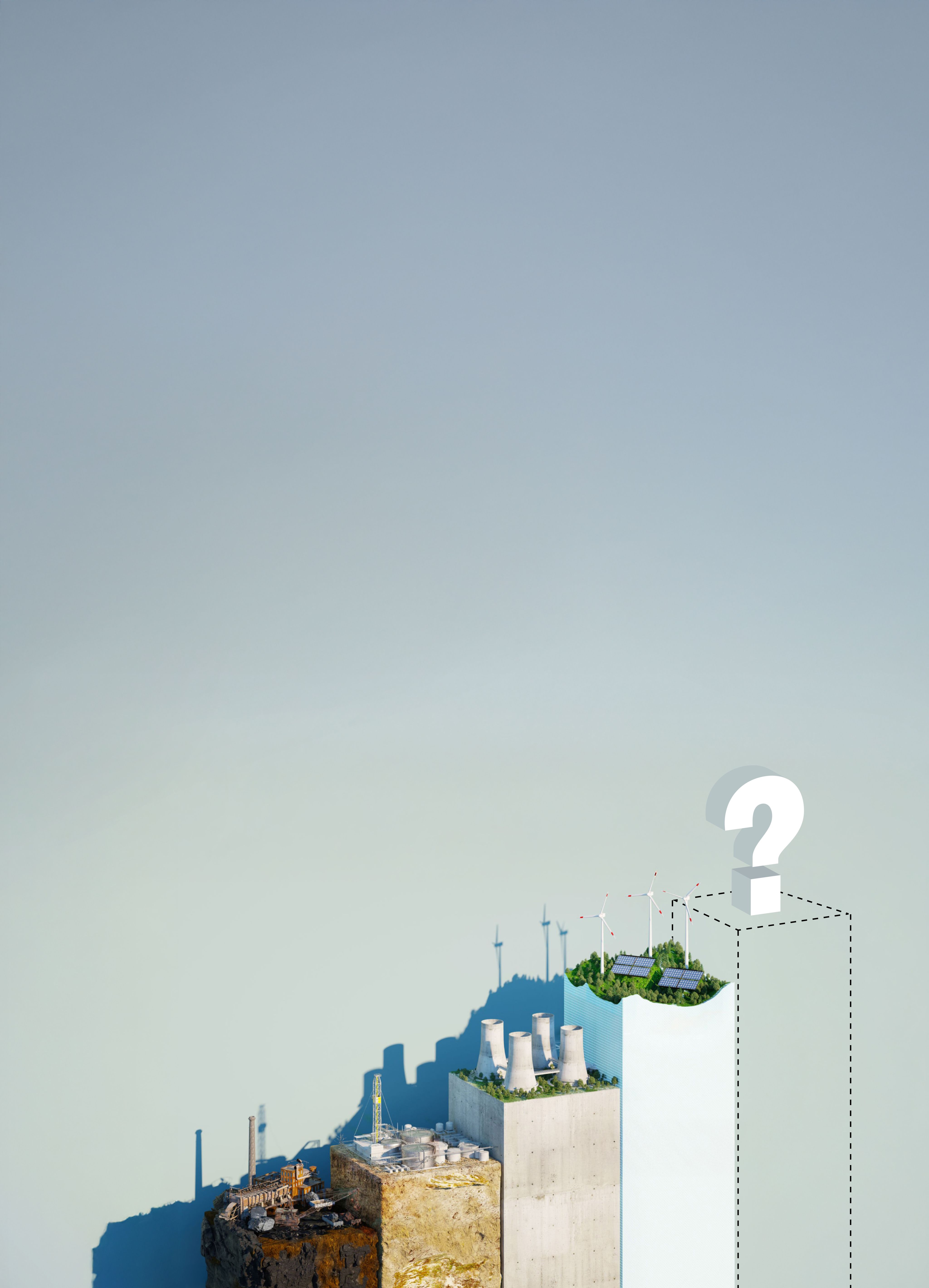

What next for business and

climate action?

What next

for business

and climate

action?

With political pushback growing and asset managers, banks and others cooling on ESG, the consensus on sustainability is on the retreat. Or is it? Karam Filfilan talks to experts from academia and finance to hear why the picture is more complicated than the headlines might appear

Remember when sustainability was something businesses proudly talked about? From reducing carbon emissions to investing in green technology, setting climate goals to hiring environmental, sustainability and governance (ESG) leads, big business was keen to shout about its green credentials.

Even the biggest investment companies were getting in on the act. In his 2020 letter to CEOs, headlined “A fundamental reshaping of finance”, BlackRock CEO and co-founder Larry Fink said, “climate change is almost invariably the top issue clients around the world raise with BlackRock”.

As such, BlackRock announced that it would be placing sustainability at the heart of its investment approach, making it integral to its portfolio construction and risk management, exiting investments that presented a high sustainability-related risk and investing in products that screened fossil fuels.

By 2023, however, Fink was no longer using the term ESG, calling it “politically weaponised” and saying he was “ashamed to have been part of this conversation” – while reiterating BlackRock’s commitment to sustainable investment. A year on, though, it was revealed that BlackRock supported just 4% of the shareholder proposals addressing ESG issues it voted on in that year, down from 47% in 2021.

BlackRock is far from the only institution to have retreated from past sustainability commitments over recent months. With oil prices rising, both BP and Shell have cut back on plans to lower carbon emissions. Microsoft has seen its total emissions rise by 30% since 2020 due to the construction of new data centres used to power artificial intelligence, while Nike has lost 30% of the employees who work on sustainability initiatives since December 2023.

Climate protestors demonstrate outside BlackRock offices

Climate protestors demonstrate outside BlackRock offices

There’s no doubt that the current political climate is having an effect on how companies talk about and enact sustainability policies. Donald Trump’s return to the presidency has seen the US shift policy on climate change, with one of his first acts being to withdraw from the Paris climate agreement – joining Iran, Libya and Yemen as the only countries standing outside the multilateral treaty. At his inauguration, Trump vowed that the US would embark on a new age of oil and gas exploration, pledging “we will drill, baby, drill”.

This sort of invective is forcing businesses to act, with many fearing a political backlash from an increasingly sceptical public. In January, six of the biggest banks in the US quit the UN-sponsored Net Zero Banking Alliance (NZBA), with analysts suggesting the withdrawals were an attempt to head off “anti-woke” attacks from right-wing politicians.

The NZBA commits members to align spending, investment and capital market activities with net-zero greenhouse gas emissions by 2050 at the latest – something many of the banks were keen to shout about prior to the change in the political climate. So are we seeing a lasting change in how businesses view sustainability and approach climate change policies?

Rhetoric or risk?

Professor Marc Lepere leads executive education on ESG and sustainability at the business school at King’s College London, and is co-founder and Chief Science Officer of ESG smart data platform Omnevue (see panel below), which describes itself as a “Quickbooks for all things ESG”. He believes that those running businesses need to decide between rhetoric and risk when it comes to climate policies.

“On the rhetoric side, I think it’s fair to say that the consensus around climate change that was in place is under pressure and has broken down, with one reason being political opportunism,” says Lepere.

“The economy is bad, change is hard – that’s where the political rhetoric of people like Trump can be appealing”

Professor Marc Lepere, King’s College London and Omnevue

“There is an underlying reason, however. There are those that have started to understand what climate change means for countries, companies and their own lives – and they realise that this is a major issue that requires systemic change in a substantive way. Faced with that, I think a lot of people simply aren’t up for dealing with it. The economy is bad, change is hard – that’s where the political rhetoric of people like Trump can be appealing,” he adds.

But Lepere questions how much impact climate deniers like Trump can have on upcoming sustainability reporting and regulation, despite all their bluster. In the EU, 2025 marks the first year in which organisations that meet certain criteria and do business in the European Economic Area have to report on a wide range of ESG issues under the Corporate Sustainability Reporting Directive. Similarly, the EU’s Sustainable Financial Disclosure Regulation requires financial market participants to release ESG information to help investors make more informed choices about where their money is going.

The recent LA fires…

The recent LA fires…

…and the aftermath

…and the aftermath

As well as the EU legislation there are new global sustainability accounting standards (IFRS S1 and S2). The UK government is expected to issue a consultation in the first quarter of this year on their endorsement for use here. It’s a “hell of a bet” for business leaders to believe all these new rules will be torn up in the face of political opportunism, argues Lepere.

To demonstrate the risk of climate change to businesses, Lepere uses a simple example. The Actuaries Climate Index is a resource used to develop predictive models for climate change-related losses. It looks at six indicators – high temperatures, low temperatures, precipitation, drought, winds and sea level – based on a benchmark between 1960 and 1990.

“Every year since 1991, the index has risen – and continues to do so alarmingly. The insurance industry is telling us the risk is real,” says Lepere.

Quiet action

Perhaps the issue for business is more around perception. If the experts are saying that the risk from climate change is real, but the rhetoric around action is negative, maybe it’s easier to do things quietly in the background. Forget greenwashing – modern businesses are focusing on greenhushing.

“Grown-up companies are very aware of the risks and I don’t believe they’re putting their heads in the sand,” says Lepere. “Having said that, there are no points to be gained from shouting loudly about this, so I do believe there are a lot of companies doing things more privately.”

One organisation that is continuing its focus on supporting its customers transition as part of its strategy is NatWest. Peter Norton CA is the bank’s Group Director of Finance and, like Lepere, was a panellist at last year’s ICAS Sustainability Summit, held in Edinburgh.

Peter Norton CA (centre) and Marc Lepere (right) at the 2024 ICAS Sustainability Summit

Peter Norton CA (centre) and Marc Lepere (right) at the 2024 ICAS Sustainability Summit

Speaking at the event, Norton asked, “The question for NatWest and other big financial institutions is: how do we support our customers to transition?

To help customers assess their emissions, NatWest has launched the carbon planner, a free-to-use digital platform designed to help UK businesses manage their future fuel and operational costs and to reduce their carbon footprint.

Collaboration is key

Partnerships are key to success in achieving climate goals across the economy, argues Norton, with buy-in required from everyone. He gives some examples of NatWest’s recent partnerships, such as with WWF-UK to help the UK’s food and agriculture sector meet climate goals, and another with McCain Foods to reduce financial barriers for potato farmers who wish to adopt more sustainable farming practices.

Helping agriculture reduce emissions is a prime goal for NatWest’s sustainability partnerships

Helping agriculture reduce emissions is a prime goal for NatWest’s sustainability partnerships

NatWest’s climate goals include reaching net zero across financed emissions, assets under management and operational value chains by 2050. It has a target to provide £100bn in climate and sustainable funding financing from July 2021 through to the end of 2025. By the end of October 2024, it had already provided around £85bn.

“The question for NatWest and other big financial institutions is: how do we support our customers to tranistion?”

Peter Norton CA, NatWest

The UK government launched the National Wealth Fund in the second half of 2024. The aim is to deploy capital into priority net-zero sectors and create markets for investment into new technologies and infrastructure which drive economic growth and job creation and ensure food and energy security for the UK. "NatWest Group was part of the task force convened to set up the National Wealth Fund," he says.

"To embed climate within decision making our customer interactions, we've developed the climate decisioning framework, which comprises the climate transition plan assessment (CTPA) and climate risk scorecard (CRS) tools. CTPA helps us to understand our customers’ transition journeys and CRS supports our understanding of how they are managing climate-related risk. We are implementing these tools on a test-and-learn basis."

Screenshot of a tweet by “@PerthshireMags”

Screenshot of a tweet by “@PerthshireMags”

Ultimately, adapting to and managing those risks requires effort and cooperation on a global scale.

“One of the problems is that the effects of climate change are distributed geographically and are relatively small events in terms of the global system. The wildfires in Los Angeles were a cataclysmic event for those in California, but in the UK, it’s a fire in Los Angeles. This game of hoping the event won’t strike where you happen to be is human nature. When it does, it’s too late,” says Lepere.

“Most experts believe that the only real economic incentive on climate is the introduction of a global carbon tax. But that would take proper political, grown-up leadership and everyone would have to buy into it,” he adds.

Is this a conversation business, governments and the wider public are ready to have?

ICAS Sustainability Summit 2025 is on 23 April at County Hall in London. Save the date

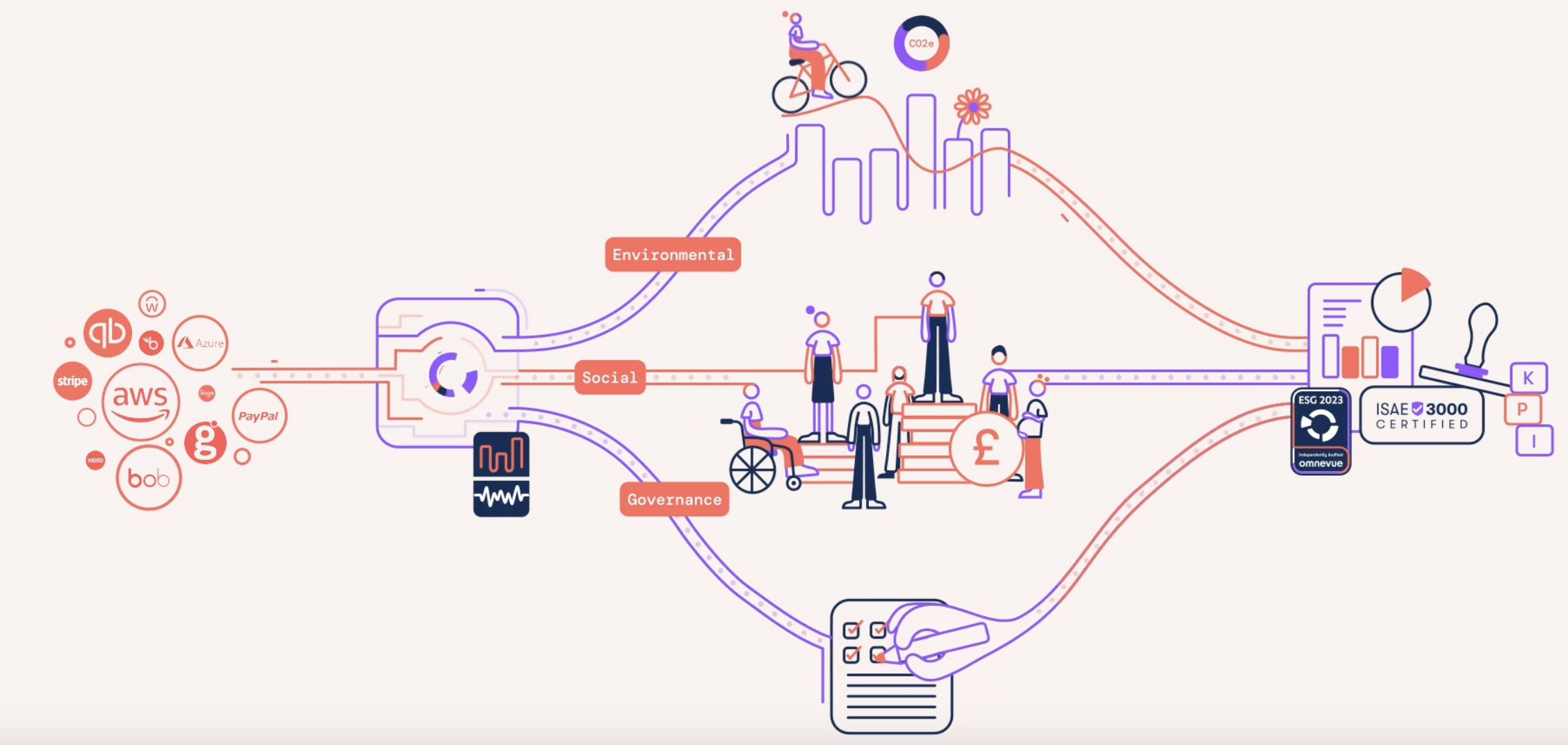

Omnevue – an ESG accounting solution

Omnevue is an ESG data collection and reporting company. Its goal is to support the top 100 UK accounting firms in launching a new ESG service line for their mid-sized business clients. It generates financial-grade, assurance-ready data that auditors can test and agree to supporting documentation.

Omnevue’s easy-to-use platform streamlines the data collection and reporting of carbon and sustainability performance. This, together with automated accounting workbooks, technical documentation and advisory modules, allows accountants to execute ESG engagements across reporting, advisory and assurance.

The company offers in-person, half-day CPD-certified training programmes that upskill accountants to identify and pitch engagements, and future-proofs them against evolving IFRS sustainability accounting standards and regulations.

Omnevue’s solutions are designed to reduce the time required to deliver an ESG engagement by up to 80%. This helps accounting firms to provide an excellent service while minimising costs and building a sustainable revenue stream.