Meet the Practice

Meet the Practice

‘Farming is everything here’

For more than 100 years, Bell Ogilvy has been working closely with businesses in and around the rural town of Castle Douglas. Current partners Lissy Gray CA and Eilidh Harman CA tell Fraser Allen why the human touch is so important in a tight-knit agricultural community

Mention KYC to Lissy Gray CA (above, left) and it’s likely to bring a wry smile to her face. “Know your client?” she says. “We know all our clients. We know their parents. We know their grandparents. We even know their cousins.

“At least half of our clients are farmers. Farming is everything here and without agriculture there would be no Castle Douglas. The bakery, the garage, the hotel – they all rely on the farming economy to some extent. The closeness of the community is what makes everything so special.”

Indeed, Bell Ogilvy is such a locally focused practice that the firm won’t take on any clients without a strong connection to the Castle Douglas area. Yet while Gray and her fellow Partner, Eilidh Harman CA (above, right), have become well-known figures in the local community, neither originally hails from Dumfries and Galloway.

Gray grew up in Fife. After enjoying economics at school, she went on to study the subject at the University of Aberdeen. “Part of my course was accountancy,” she says. “That meant you got put into the ICAS milk round, meeting all the accountancy firms. I was offered a trainee job with Scott & Paterson in Edinburgh, where I wanted to return to. Then I came down here one weekend, with a girl I shared a flat with, and met the man who became my husband.” A series of posts followed, initially with Manson & Partners in Dumfries, before she joined Bell Ogilvy in 2003.

Meanwhile, Harman grew up in Ayr. “I liked accounting at school,” she says. “But I was also a passionate ice skater, so I thought about being a skating coach. However, my dad pointed out that if I wanted to coach I’d need to get up first thing in the morning, and be working at 6am on a Saturday when all my friends were off for the weekend. So I decided to become an accountant.”

Harman graduated in accountancy and finance from the University of Strathclyde and, not being keen on joining a large firm, secured a trainee position with Dumfries firm Carson & Trotter, which offered the variety of work she sought. “My geography wasn’t great though,” she says. “I didn’t realise I couldn’t travel from Ayr to Dumfries every day, so I ended up moving there.”

Harman also reveals that she almost appeared in a CA magazine profile of the firm around that time, but left just before it happened. Romance with a colleague had blossomed into marriage, and she felt it would be healthier if she and her husband worked in different practices. It was then, in 2013, that she joined Bell Ogilvy, becoming a partner in 2017. Harman and Gray have been the sole partners since 2020, when Eileen Tweedie CA retired after almost 24 years with the firm.

100 and counting

The origins of Bell Ogilvy are lost to history, but the practice is thought to have been founded in the early 20th century and, based on the best guesses of previous partners, Gray and Harman celebrated its centenary in 2021. Yet the firm’s focus on close client relationships and flexibility is long engrained. “Most of our clients like dealing with us face to face,” says Harman. “And we don’t force clients down the digital route if that’s not for them. We have a mix of people who still like everything on paper and those who want everything electronic.”

Frequency of contact is another feature of the practice, with Bell Ogilvy often performing a business advisory role on a week-to-week basis – an approach that Gray and Harman are keen to continue building on. One topic that has featured regularly in client conversations since 30 October is the reform of agricultural property relief (APR) for inheritance tax (IHT) announced in the Budget.

“Hundred per cent APR only came in from 1992, so we are confident that we can help the farming community pass their farms down through the family”

Eilidh Harman CA

“We will be helping our clients to plan well ahead because the sooner they act, the better their chance of mitigating or reducing their exposure to IHT,” says Harman. “Hundred per cent APR only came in from 1992, so we are confident that we can help the farming community pass their farms down through the family. Plans can be reviewed and updated, but it’s important that they don’t keep putting it off. We are looking to meet with all our clients early this year to help them prepare.”

There are currently around 20 people in the Bell Ogilvy team, all based at the one office in Castle Douglas. One challenge of running a rural practice is that it can make staff recruitment even harder. “It’s tricky trying to encourage people to move to Dumfries and Galloway,” says Harman. “It’s such a nice place to live and bring up kids, but it doesn’t have a Costa Coffee on every corner, and that puts some people off.”

However, the duo are looking forward to welcoming an ICAS trainee to the team in March, bringing fresh thinking and knowledge to the workplace. And the new recruit is likely to discover an enjoyable environment in which to develop their career, with the partners placing an emphasis on a positive work-life balance. For instance, all full-time staff now have the option of taking Friday afternoons off, and Harman and Gray hope to move the practice to a four-day week.

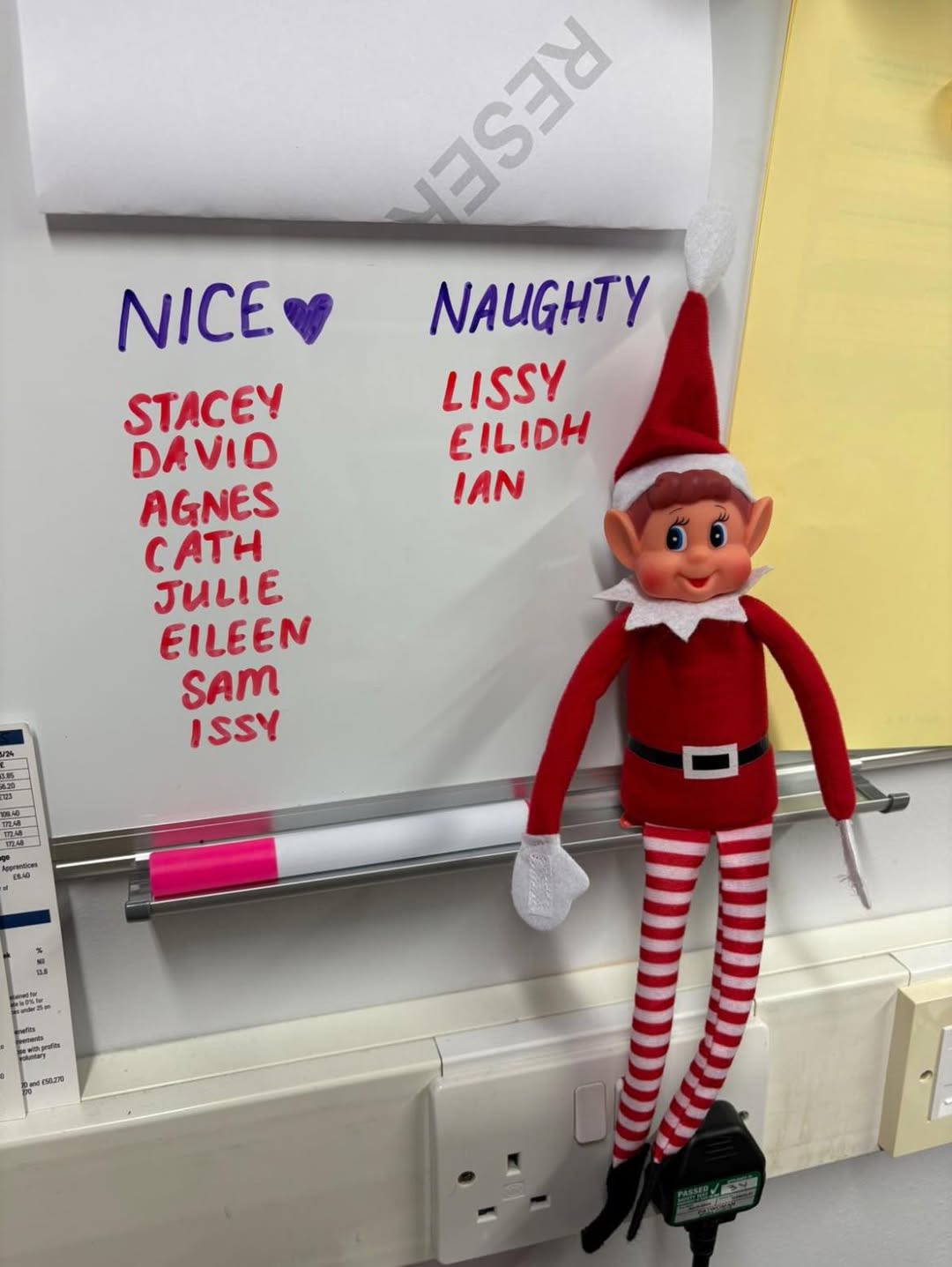

When we speak, the pair also admit to being placed on the naughty step for unspecified misdemeanours by Bello, the office elf. The pre-Christmas antics of Bello on the firm’s regularly updated Facebook page certainly point to an office culture that allows space for people to let their hair down. “Communications are a big thing here,” smiles Harman.

Elf-regulation at Bell Ogilvy

Elf-regulation at Bell Ogilvy

It’s this outlook that has helped Bell Ogilvy notch up its first century and rise to challenges such as heightened regulation, technological change and the pressures of the pandemic, on both the practice and the community it serves.

And then there’s another critical factor – the mutual trust between partners. “There’s never been any doubt about reliability,” says Gray. “I’m never thinking, ‘Did Eilidh get that right?’ There’s full confidence in each other’s ability.”

Tighten up

David Menzies CA, Director of Practice, explains the need for ICAS’ stricter AML regulatory action

In 2017, the UK Money Laundering Regulations were amended to bring in a range of new requirements for accountancy practices and other businesses, significantly impacting how clients should be handled throughout the lifespan of a business relationship.

Since then, both at a national and international level, there has been an increased focus on the harms of economic crime. This extends far beyond what many think of simply as money laundering and includes modern slavery, human trafficking and fraud, as well as terrorist financing and financial and economic sanctions. Relevant to our profession, there is a focus on the part that professional service firms such as accountants, auditors and insolvency practitioners play in the system, either deliberately or unwittingly.

With ICAS’ focus on ethical leadership, it is right that we, and our supervised firms, contribute to that fight. Monitoring visits demonstrate that our supervised firms are mostly compliant and undertaking their responsibilities diligently. However, some firms still aren’t paying sufficient attention to the requirements. This means they are putting themselves, the wider profession and society at risk. Their failures also lead to an uneven playing field with those firms that do take action to fulfil their responsibilities.

Against this backdrop, it is only right that we must now take a more robust regulatory approach.

The ICAS Authorisation Committee has recently approved changes to the way it will deal with anti-money laundering (AML) non-compliance. This is set out in a new AML Regulatory Actions Guidance document.

The guidance, which will be used by the Committee from 7 April 2025 onwards, changes the approach in two main ways:

- Tariffs: the guidance will now include indicative regulatory penalties in response to eight categories of non-compliance, including failures in relation to customer due diligence and firm-wide processes.

- Timing: to make the process more efficient, AML non-compliance will be considered by the committee at the earliest opportunity following identification on a monitoring visit.

Financial penalties can be expected where firms have not given the AML requirements appropriate attention, including failures to take appropriate action in response to issues identified in previous monitoring visits.

Firms should review the eight categories of non-compliance in the guidance and consider whether action should be taken to achieve compliance.

The regulatory approach adopted by ICAS will continue to be proportionate and will include support to help firms meet the required standards where necessary. Going forward, ICAS will be extending the level of AML support provided to firms. This includes recently published AML in focus on-demand webinars and All too familiar training resources. Watch out for future articles, videos and other communications.

Download the AML Regulatory Actions Guidance