ANTI-FRAUD SQUAD

CAs in the digital age

With tech playing an ever-greater role in financial services, Fiona Nicolson hears about the ICAS courses helping finance professionals get to grips with the fast-changing future

The rapid advance of technology is driving the evolution of the accountancy profession and the skillset of its practitioners. Strong digital skills are becoming crucial, both for those already in the profession and those yet to join.

To help CAs and other finance professionals stay ahead of developments, ICAS, together with professional development partner BPP, is running a range of technology and financial-modelling courses between April and December. These include Excel essentials for modelling and analysis, as well as Excel with data analysis at intermediate and advanced levels; Power BI (a platform for data analysis); cybersecurity; and financial modelling. Some are held online, others take place in London and Edinburgh.

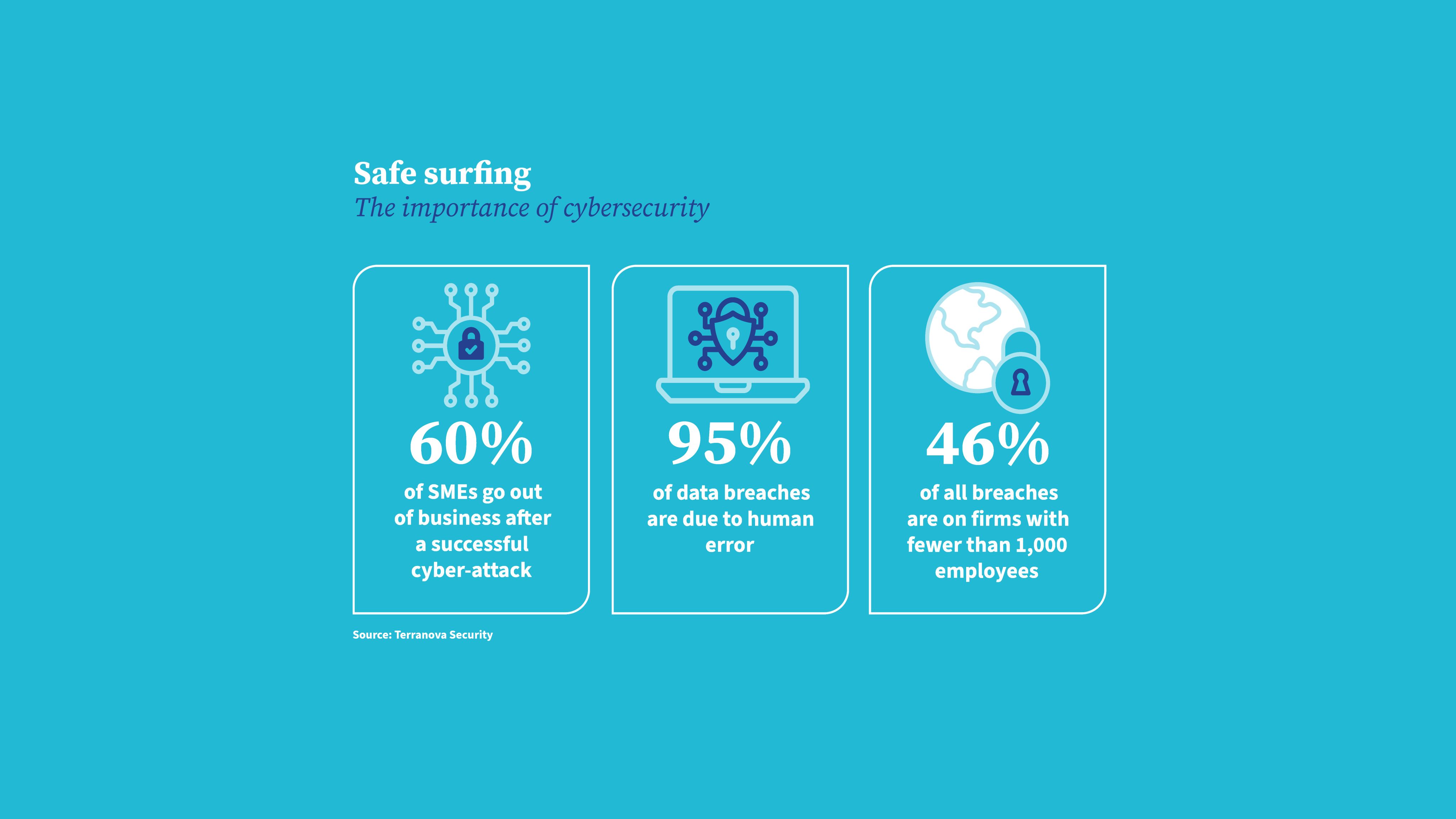

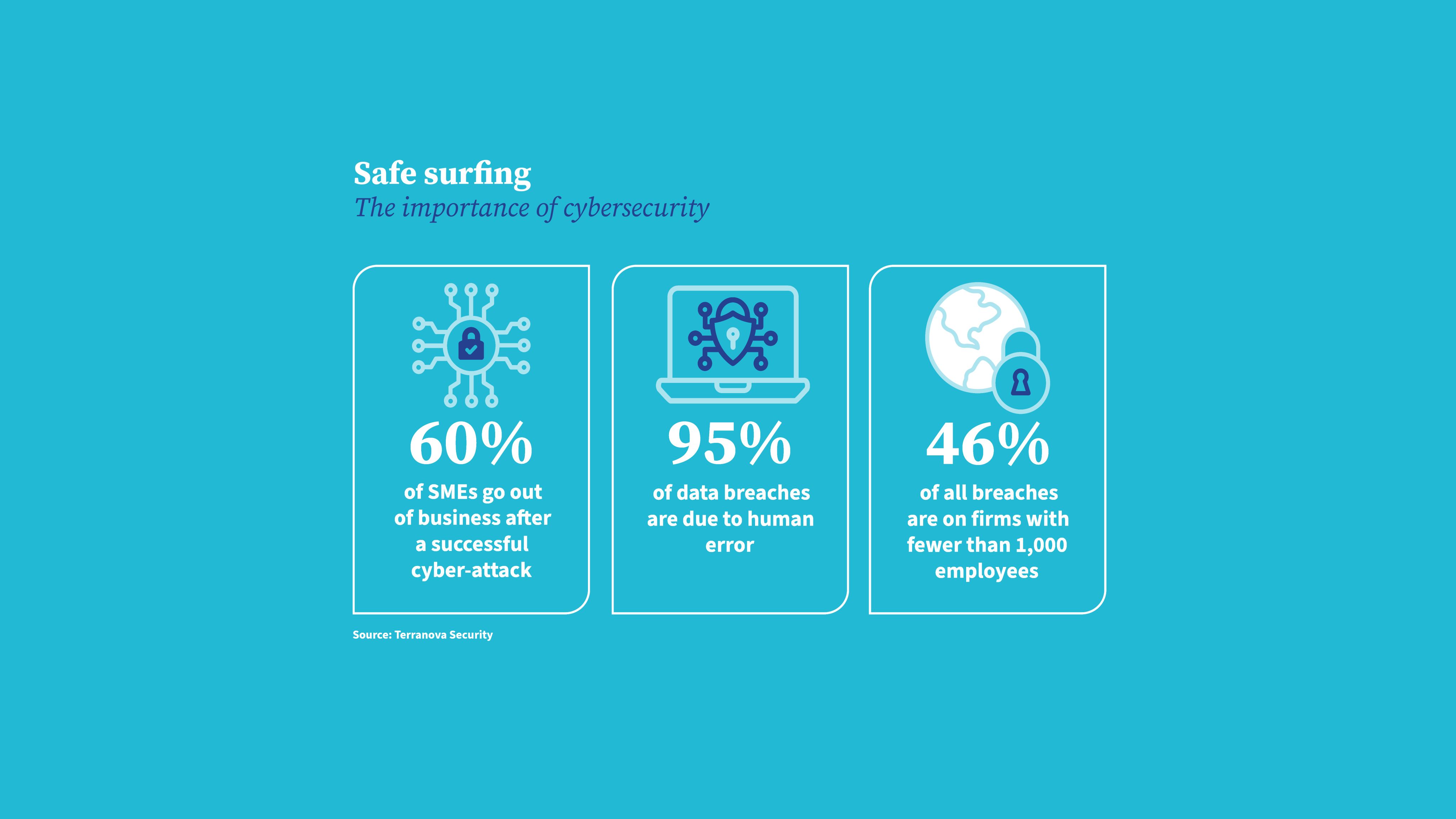

Pratish Sharma, who is running cybersecurity, Excel, Power BI and data-analysis sessions, explains why such courses are essential for CAs: “As we expand our digital footprint, it has become more and more challenging to keep our financial data secure.”

He adds: “The world is now grappling with new AI technology and its capabilities. These are increasingly powerful tools, which if misused, can have devastating effects. It has therefore become ever more vital to implement tighter controls and increase our awareness (see boxout).

“The cybersecurity courses help identify fraud, as well as covering how to stay vigilant, report suspicious activity and look for the signs of an attack. Our most important aim, though, is prevention. The sessions cover everyday tasks such as increasing password strength, understanding network permissions, recognising fraudulent sites, risk assessment and the implications of accessing public wi-fi and using outdated software.”

Sharma also explains why digital and data-analysis skills are necessary now and for the future: “Being data savvy is key to staying relevant in today’s competitive market. Trends show an upward demand in digital skills and in using cutting-edge tools to help point the business in the right direction.”

All hands

Whatever the subject, Sharma’s training has one common theme – an emphasis on the importance of practice: “I believe in learning by doing, so the courses are practical and hands-on all the way through. The sessions are designed with real-life business problems in mind, and we find solutions to those scenarios together.

“They also provide the opportunity for discussion and to share knowledge gained from our experiences in business. Participants leave with the ability to implement powerful digital tools and skills as soon as they get back to work.”

As well as having many years’ experience as a trainer in emerging technologies, Sharma is a public speaker and coach. He has delivered training programmes for a range of well-known businesses and organisations in the UK, such as the NHS, solicitors Burges Salmon, Boots, the Ministry of Defence and Westminster City Council. He is also an ethical-hacking practitioner and advises organisations on safe practice for their digital activity. He says: “Ethical hacking is a surefire way to understand where and how a problem starts. It is about taking a systematic and questioning approach to all things digital.”

How to excel at data modelling

Trainer Dave Marlow CA, a financial-modelling specialist for around 25 years, will be sharing his expertise on a number of two-day courses. Marlow qualified while working at PwC, then began a career in training, first within the Big Four giant and then with other firms in London. He has wide-ranging experience, including in building financial models to help bankers with their investment decisions.

In addition to covering the Excel functionality required to construct financial models, Marlow’s courses focus on what he regards as the golden rules of financial modelling. “These are the dos and don’ts that must be adhered to if an accountant wants to build a high-quality model that is dynamic, flexible, scalable and sturdy,” he explains.

Gaining proficiency in this field requires learning and applying all of these principles, Marlow believes. One of the main rules refers to the importance of avoiding errors. He advises: “Incorporate checks and balances wherever possible. Failure to do this will result in mistakes not being identified and will increase the difficulty of fixing those problems later on.”

Feedback suggests the course content can be a revelation. “Some delegates comment that they have been doing financial modelling for years on a self-taught basis but that this has shown them how it should be done – and that they now wish they’d taken the course years ago,” Marlow says. “Clients expect exemplary service from their financial-service providers, and a sound grasp of financial-modelling principles is certainly one way to help an accountant satisfy their clients’ requirements.”

Learn more about ICAS’ digital and technology courses