A blueprint for better business

Good governance only hits the headlines when its absence has catastrophic consequences, as recent events have shown. Here, Dr Roger Barker of the IoD puts the case for making it the cornerstone of any successful enterprise – and sets out his three-point plan for the next government

Words: Ryan Herman

When a business or organisation is engulfed in scandal, the finger-pointing and blame-shifting is rarely far behind. Often, though, rather than being a matter of identifying the “guilty parties”, the real reason for the problem is less individual, more structural – namely, a failure of governance.

For the media, governance makes for a poor “culprit”, however, being too dry, abstract and faceless to produce a good headline. Yet it clearly matters, both for businesses and the wider economy. Writing in CA magazine in December, ICAS CEO Bruce Cartwright CA observed that “strong corporate governance improves financial viability, attracting investment and improving stock market performance, as well as rooting out the wasteful parts of a business. It would, in other words, help with the growth agenda.

He adds: “ICAS has been extremely vocal in calling for the UK government to speed up legislation on corporate governance reform. We’ve met with ministers, other politicians and civil servants to urge them that the need for this reform has never been greater, only to be met with delays. We’re now in conversation with opposition MPs about the need to make this a priority for any new government after the general election.”

In 2024, governance is very much on trend. The year started with ITV’s drama Mr Bates vs the Post Office. Months later, startling information about the failings in governance at the Post Office continue to emerge through the public inquiry, which is due to conclude in July.

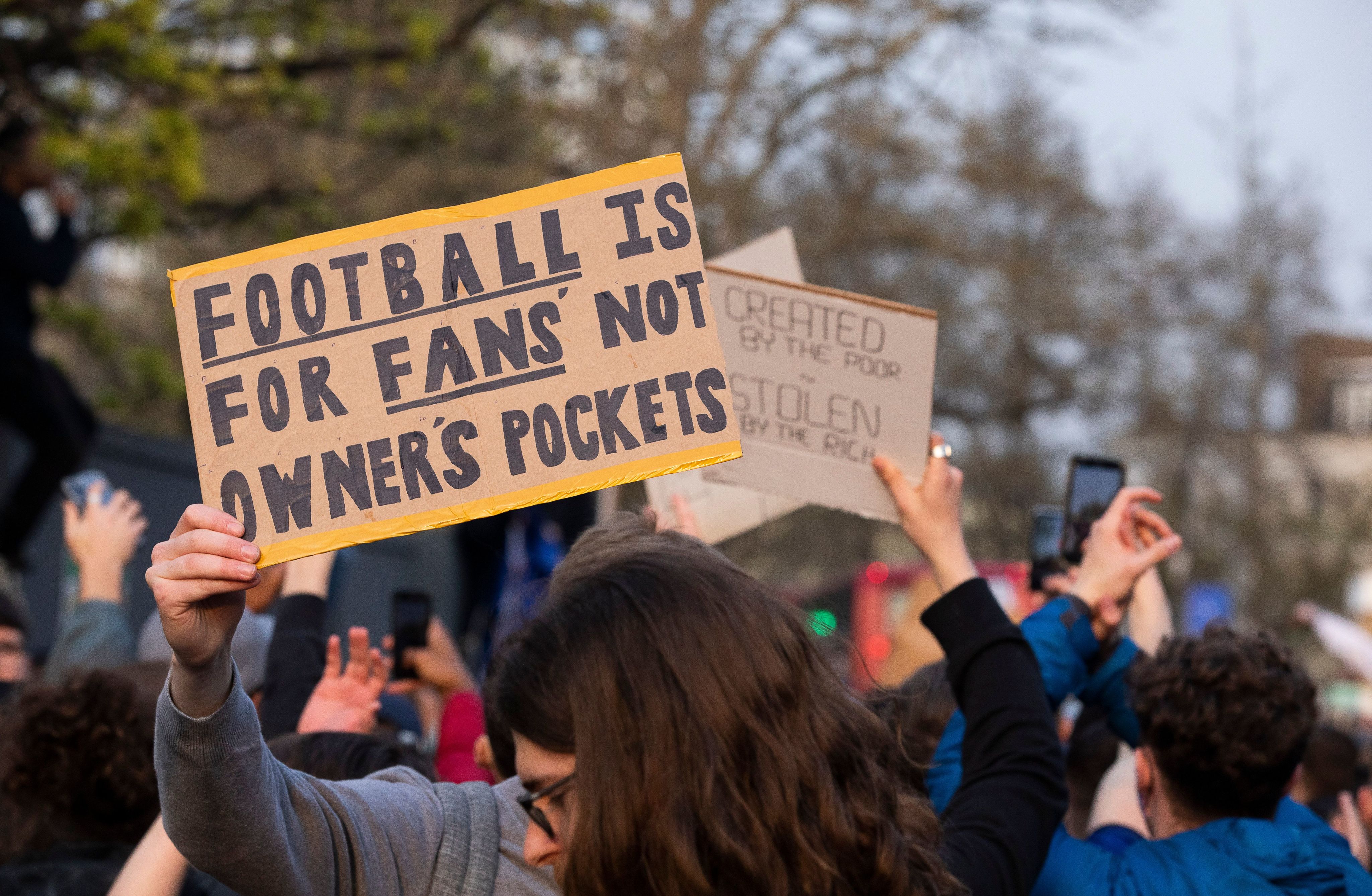

Meanwhile, in March, the government launched the Football Governance Bill that will see the national game get its own independent regulator. Even though the English Premier League ranks among the UK’s most successful cultural exports, club football in England and Wales is drowning in debt.

“Good governance is a prerequisite for achieving progress in anything else. You get it right, then you can move on to think about sustainability and social impact”

“It’s quite a major development; the state intervening in the running of this activity [football] is something it hasn’t really done in the past,” says Dr Roger Barker, Director of Policy and Corporate Governance at the Institute of Directors (IoD), the body that has been tasked with promoting good governance, and representing the interests of UK business, since 1903.

“It’s a major crossing of the Rubicon, but unfortunately it seems to have become necessary. This is not just a private activity that people are doing among themselves and should be allowed to just get on with it. It is part of the national fabric, a major public good. It’s too important to the culture of a country to allow, as it were, a narrow group of individuals to make all the key decisions about it,” he adds.

“Like many things in governance, it was a response to bad things happening,” he says. “The wake-up call was probably the attempt to create the European Super League [six Premier League clubs signed up to an elite breakaway competition in April 2021], which wasn’t aligned with the fans’ interests but did seem to be very much in the interest of the owners.”

Barker lives and breathes governance. Accordingly, he welcomes the subject being in the spotlight, and the wider public recognition of its importance that comes with it, even though he knows that typically only happens when things go wrong.

Toby Jones as Alan Bates in ITV's Mr Bates vs the Post Office hit drama

Toby Jones as Alan Bates in ITV's Mr Bates vs the Post Office hit drama

“The dialogue around governance tends to move in cycles,” he says. “You typically get a knee-jerk reaction, along the lines of, ‘Where was the governance? Where were the directors? We need to do something about this!’

“When things are going well, success is almost its own justification, and people are less and less concerned. But, of course, things do inevitably go wrong from time to time and when companies have been coasting without good governance, experience has taught us that these things tend to catch up with you.”

Regulation time

Whether an independent regulator provides a solution is a moot point. Ofwat didn’t intervene when Thames Water borrowed money to pay dividends to its shareholders.

In the case of the Post Office, Barker says the complex way in which it is structured as a state-owned private company has meant that when something went wrong, it could be passed off as somebody else’s fault.

“What we haven’t done yet with the Post Office is lift up the bonnet and look at what the board, in particular, was doing at different stages along the journey – to look at the minutes of the board meetings. That would be one way of conducting a forensic board evaluation of what went wrong,” he says.

Of course, we shouldn’t lose sight of the fact that the overwhelming majority of businesses apply best practice around governance in their decision-making. But if Barker were given a blank sheet of paper on which to draft a blueprint for the next government, what would he include? Here’s his response:

Dr Roger Barker’s three-point plan for better governance

“1) We would want to push forward with elements of the post-Carillion corporate governance reforms. The most important part is to implement the transformation of the FRC [Financial Reporting Council] into its replacement Arga [Audit, Reporting and Governance Authority].

“The FRC is currently in limbo. It has been preparing for this change for some time, it’s trying to move forward under its own steam as far as it can. But there are limits to how far it can go without legislative change. It’s important to move forward with [that change].

“But there are some elements of the reforms that are worth looking at. For example, the IoD has never really been convinced about the proposal to introduce managed shared audits in the UK.

“With some of the new corporate disclosures that were being mandated in these reforms, is that actually going to result in any underlying change to corporate behaviour? I’m thinking of things like the potential Resilience Statement, the implementation of which was suspended by the government last year.

“2) The next government should have a look at directors’ legal duties as defined in the Companies Act. It’s now almost 20 years since company law was reformed. One of the key duties in the Companies Act relating to directors is section 172, which requires the directors to promote the success of the company in the interests of its members – ie, its shareholders.

“The IoD for a little while now has been supporting the Better Business Act campaign, which is calling for reform of section 172 to reflect a duty whereby directors would promote the success of the organisation, full stop – “the organisation” actually being the joint effort of various stakeholders who may contribute in differing ways to its long-term sustainable success.

“Our view is that any good director nowadays will govern their organisation with that in mind. We feel that company law still needs to catch up. So we’d advocate the government taking a look at that, especially when considering ESG [environmental, social, governance] issues such as climate change, sustainability and how best for business to interact with the rest of society.

“3) The IoD is currently drafting a voluntary code of conduct for directors. We have a commission, led by Lord Ian McNicol and 16 other commissioners, who are thinking about how we can create something to guide individual directors into behaving ethically and appropriately. It’s actually quite amazing, I think, that this isn’t part of the current business framework. You think of any other profession – accountants, for example – and part of their licence to operate is a code of conduct, against which they can be held accountable.

“We are going to be publishing a version of this code in June for a public consultation process. We would like the next government to promote the adoption of this code of conduct by directors of all kinds of organisations across the UK”

Expanding on the second point, Barker says, “I slightly regret the fact that corporate governance has been lumped together as part of the ESG concept which, of course, was developed by investors – it’s an investor-oriented organising principle.

“One of the problems in conflating governance into ESG is the risk of it leading to a lack of focus on the matter, because a lot of the focus in ESG, quite rightly, goes on issues related to climate change and environmental impacts. But that doesn’t mean that we should neglect governance.

Thames Water may need a government bail-out to help it clean up the rivers, despite paying significant dividends to its shareholders

Thames Water may need a government bail-out to help it clean up the rivers, despite paying significant dividends to its shareholders

“In some respects, governance sits above the E and the S. It’s fundamentally different in nature because governance is about the decision-making process, not the decisions themselves. It’s not about what we do in sustainability, or how we should address the social impact of our organisation, it’s about how we come to make those decisions in the first place.

“Good governance is a prerequisite for achieving progress in anything else. So you’ve got to think about your governance very distinctly. You get it right, then you can move on to think about sustainability and social impact.”

For all this, governance is a part of business life that is sometimes viewed negatively, the accusation being that it stifles growth and innovation. Which perhaps explains why it is not considered a priority for the government.

“It’s actually quite amazing that a guide for individual directors behaving ethically and appropriately isn’t part of the current business framework”

“There is significant pressure from some parts of the business community, who are saying ‘Look, we need to be very careful about the regulatory burden that we have imposed on business,’” says Barker. “London as a financial centre is currently suffering very badly with a loss of IPO [initial public offering] business. It has been precipitously slipping down the global league tables in terms of capital raising, and there is a real sensitivity about introducing new regulatory requirements.

“There’s a body called the Capital Markets Industry Taskforce, which has been influential with the government in the past 12 months. It has been publishing open letters on behalf of City business leaders and financial actors, saying we shouldn’t be imposing government requirements which are more onerous than in other competitive centres.”

Chelsea fans protest against the proposed European Super League in 2021

Chelsea fans protest against the proposed European Super League in 2021

But governance isn’t just about corporations and the FTSE. It should concern everyone, from the Big Four to a sole practitioner running their own accounting firm.

“[The time] when a small company really needs to have a look at its governance is at a time of change in its fortunes or activities. This may be when the company is growing very rapidly, looking to raise finance externally, or during a change of strategy.

“All these points in the lifecycle of the company offer an opportunity to ask whether your governance is fit for purpose. That will often mean bringing in a more independent perspective to oversee, or add input to, the company’s activities – an evolutionary step that should be viewed as an opportunity.”

Ultimately, as Barker, concludes: “Good governance should be something which benefits you and underpins the long-term success of your business.”

Learn more with ICAS’ Corporate Governance – Introduction course