Reap the rewards

We spotlight some of our partners to show the benefits of the member rewards programme, including discounts, special offers and more

Introductory commission for ICAS members

Last year, White Oak UK solidified its commitment to the Scottish business community by establishing a strategic partnership with ICAS. This collaboration has paved the way for White Oak UK to provide substantial support, with £40m already invested in Scottish SMEs.

Operating from our Glasgow base, White Oak UK stands out as one of the few alternative lenders offering localised support to Scottish firms through our partnership with ICAS members. Our dedicated local presence has fostered enduring relationships with ICAS clients, contributing to the growth of businesses across the region.

Tailored finance solutions for business growth

White Oak UK specialises in finance solutions designed to fuel business growth. Our offerings include self-assessment tax, professional indemnity insurance and VAT solutions. We provide fixed-rate, unsecured business loans with flexible repayment terms.

In addition to our comprehensive asset finance product, we’ve extended £60m in asset refinance solutions in the Scottish market since 2019. This product is specifically crafted to meet the unique needs of sectors such as waste management, manufacturing, construction and transport.

Over three decades of expertise in Scottish accountancy

With over 35 years of experience, White Oak UK has been a trusted partner in providing finance and cashflow solutions to the accountancy sector in Scotland. Leveraging both direct and external funding channels spanning the entire market, we offer unparalleled flexibility to support diverse funding requirements.

Streamlined application process

Applying for White Oak UK’s financing solutions is seamless. You and your clients will be assigned a dedicated ICAS Account Manager, Ross Grant, a specialist in the accountancy sector. Ross takes the time to understand your unique needs and provides flexible solutions tailored to your business.

Rewarding partnerships with ICAS accountants

ICAS accountants can benefit from a referral fee when their clients gain swift access to White Oak UK’s funding. With a suite of lending products, including commercial loans, asset and invoice finance, you and your clients have a comprehensive range of options to support sustainable growth.

whiteoakuk.com

For more information, please contact Ross Grant at ross.grant@whiteoakuk.com or call 01244 527300

Free 30-minute financial planning consultation

At Mazars, we believe personal financial planning should be holistic, which is why our private client team consists of experienced and highly qualified experts, including financial planners, investment managers and tax advisers.

Mazars private client is part of Mazars, the international accounting and advisory firm, and we have advisers based in 14 locations across the UK, including Edinburgh, Glasgow and London. Last year our private client team was ranked as the second-best firm in FTAdviser’s Top 100 list and was awarded Advice Firm of the Year 2023 by Money Marketing.

We pride ourselves on the service we provide to our clients, and many of our advisers have been featured in VouchedFor’s Top Rated Advisers List, with the firm being named a Top Rated Advice Firm for the fourth consecutive year.

We are delighted to have partnered with ICAS to support its members with personal wealth-planning solutions. As partners, we will be running online and in-person sessions on wealth accumulation, including investment planning, pension savings and financial protection, pension planning and retirement income strategies for those approaching retirement, and tax opportunities for high earners.

As a member of ICAS, you can enjoy a free 30-minute consultation with one of our advisers.

Register here for your free consultation

Save 10%* on Bupa By You health insurance

With Bupa By You, you can choose the level of cover to suit your needs.

What can Bupa By You health insurance offer you?

· Book GP appointments any time of the night or day, with our Bupa Blua Health app.

· Worried about your health? Our nurses are there for you, all day, every day. Just call our Anytime Healthline.

· Our cancer promise means that we'll look after you, from diagnosis to care, for as long as you have Bupa By You health insurance with cancer cover included. **

To find out more about your options, call one of our friendly team on 0808 250 7588, 8am–8pm Monday–Friday, or visit us online

* Applies to eligible ICAS members on quotes for new Bupa By You policies. Discounts will be reviewed on 21/01/2025 and any changes will then apply to renewals and new quotes taken out after that date. Quotes are valid for 14 days. Terms and conditions apply.

**With Bupa full cancer cover, there are no limits on how long your treatment lasts or how much it costs, for as long as you have Bupa health insurance with full cancer cover. You must use a hospital or health centre from the Bupa network and a consultant that we recognise and charges within Bupa rates (a fee-assured consultant).

ICAS introduces Bupa health insurance. Bupa health insurance is provided by Bupa Insurance Limited. Registered in England and Wales with registration number 3956433. Bupa Insurance Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Arranged and administered by Bupa Insurance Services Limited, which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales with registration number 3829851.

Registered office: 1 Angel Court, London EC2R 7HJ

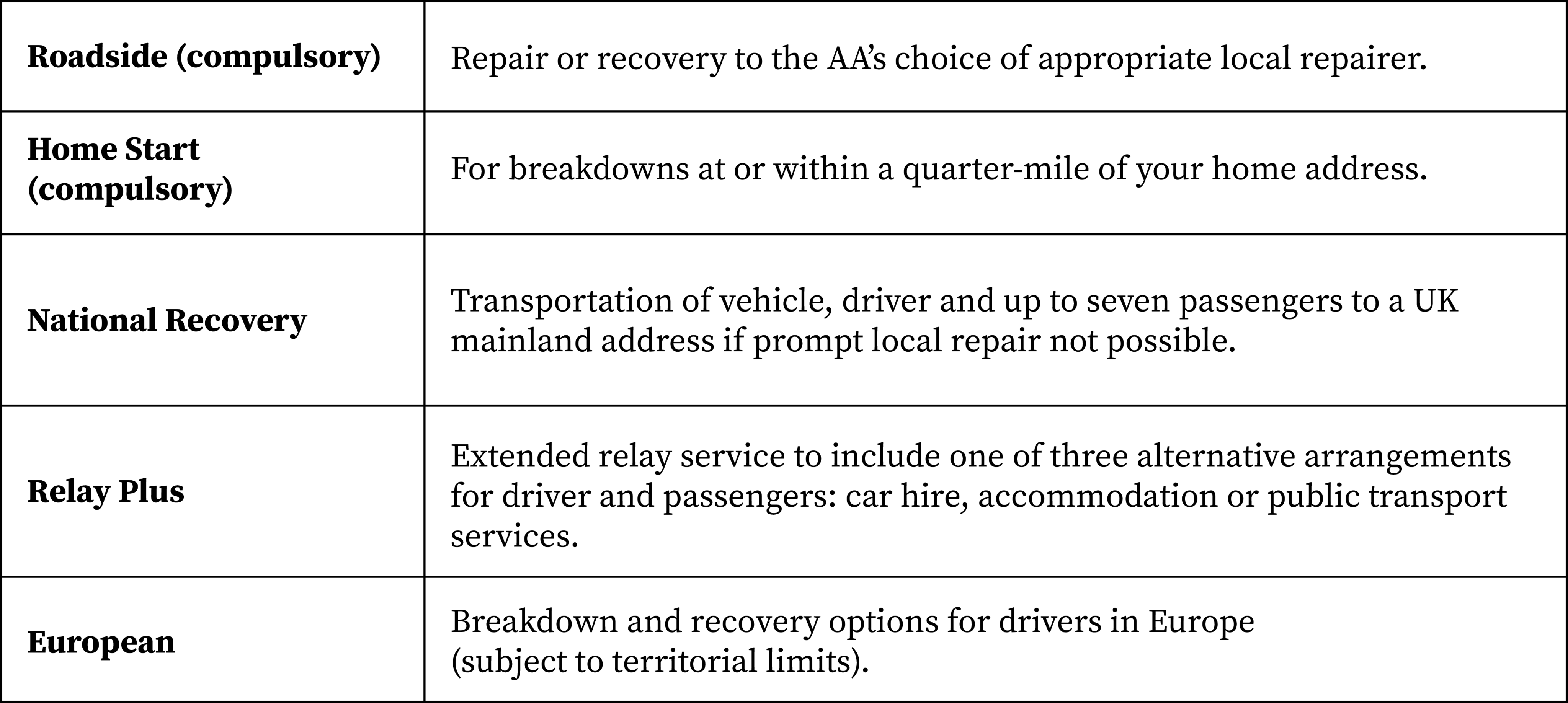

Business breakdown cover from the AA

Running a company with vehicles at its heart means that staying still isn’t an option. Business breakdown cover from the AA will make sure your drivers get back on the road quickly – and with minimum disruption – if the worst happens. All you need to do is choose the type of cover that suits you.

Which vehicles can be covered?

Whether you just have a single vehicle or run a whole fleet, the AA can cover your cars, vans, trucks and more – as long as they’re 3.5 tonnes or under. If you’re not sure if your vehicle would be eligible, you can call the AA on 0800 55 11 88 to check.

What does cover include?

You can choose from the following options for your company’s vehicles:

|

Roadside (compulsory) |

Repair or recovery to the AA’s choice of appropriate local repairer. |

|

Home Start (compulsory) |

For breakdowns at or within a quarter-mile of your home address.

|

|

National Recovery |

Transportation of vehicle, driver and up to seven passengers to a UK mainland address if prompt local repair not possible.

|

|

Relay Plus |

Extended relay service to include one of three alternative arrangements for driver and passengers: car hire, accommodation or public transport services. |

|

European |

Breakdown and recovery options for drivers in Europe (subject to territorial limits). |

Up to 59% off UK business breakdown cover for ICAS†

Cover from just £61.22 per vehicle, for fleets of three or more vehicles!

Visit theAA.com/business and ask for a quote, using reference code 0377 or AA Business Breakdown Cover / ICAS

†Savings based on Fleetwide 3 Standard rates for 3-6 vehicles. £61.22 for Roadside and Home Start cover (Fleetwide 5). Fleetwide cover does not apply to specialist vehicles, ie taxis, mini cabs, hire vehicles, ambulances, police vehicles, vehicles on trade plates, minibuses, privately owned vehicles (unless used for business purposes), motorcycles and courier vehicles (all of which can be covered on Specialist rates, call 0800 55 11 88 for details), or any vehicles over 3.5 tonnes GVW.

Offer cannot be used in conjunction with any other offer. Offer prices are only available while your ICAS membership is current. We reserve the right to review pricing at any time. Full terms and conditions available on request by calling 0800 55 11 88.

Business breakdown cover from the AA

Running a company with vehicles at its heart means that staying still isn’t an option. Business breakdown cover from the AA will make sure your drivers get back on the road quickly – and with minimum disruption – if the worst happens. All you need to do is choose the type of cover that suits you.

Which vehicles can be covered?

Whether you just have a single vehicle or run a whole fleet, the AA can cover your cars, vans, trucks and more – as long as they’re 3.5 tonnes or under. If you’re not sure if your vehicle would be eligible, you can call the AA on 0800 55 11 88 to check.

What does cover include?

You can choose from the following options for your company’s vehicles:

Up to 59% off UK business breakdown cover for ICAS†

Cover from just £61.22 per vehicle, for fleets of three or more vehicles!

Visit theAA.com/business and ask for a quote, using reference code 0377 or AA Business Breakdown Cover / ICAS

†Savings based on Fleetwide 3 Standard rates for 3-6 vehicles. £61.22 for Roadside and Home Start cover (Fleetwide 5). Fleetwide cover does not apply to specialist vehicles, ie taxis, mini cabs, hire vehicles, ambulances, police vehicles, vehicles on trade plates, minibuses, privately owned vehicles (unless used for business purposes), motorcycles and courier vehicles (all of which can be covered on Specialist rates, call 0800 55 11 88 for details), or any vehicles over 3.5 tonnes GVW.

Offer cannot be used in conjunction with any other offer. Offer prices are only available while your ICAS membership is current. We reserve the right to review pricing at any time. Full terms and conditions available on request by calling 0800 55 11 88.