Accounting for

CRYPTO

With decentralised currencies gaining a new respectability, finance professionals may soon have to treat them as they would any other financial holding. But how does an accountant assign a value to something that can make a rollercoaster ride look like a walk in the park? Nicola K Smith investigates

Crypto has been, it’s fair to say, having a moment. At time of writing, the total value of cryptocurrencies stands at around $3.2trn (£2.6trn), up from $1.8trn a year ago. While much of that surge has come since the re-election of the crypto-friendly President Trump, its resurgence predated the November vote. In January 2024, the SEC allowed the first US exchange traded funds (ETFs) to track bitcoin – an indication that the world of decentralised, unregulated investment had gained a new respectability. Its inclusion in ETFs meant crypto investment was suddenly available to people who might have felt nervous about the actual buying and selling process.

But with that come responsibilities, such as tax and accounting. So how do CAs evaluate crypto holdings which can fluctuate so wildly – let alone meme coins, which can crash and burn in the space of a few hours?

The benefits of crypto-assets include faster, lower-cost transactions, improved liquidity, access to new capital markets, greater transparency and a hedge against inflation and movements in fiat currencies.

Indeed, research from the Financial Conduct Authority (FCA) in November 2024 shows that 12% of UK adults now own some form of digital asset, up from 4.4% in 2021, while businesses are increasingly interested in cryptocurrencies and tokenisation of assets.

But there are also some weighty considerations, not least uncertain regulation and compliance, enormous volatility and financial risk. Indeed, there is striking ignorance among many crypto investors, around one-third of whom believe they could seek financial protection for their investments from the FCA, just as they could with regular savings. In fact, the Financial Services Compensation Scheme does not cover crypto.

So this space presents a unique challenge – and perhaps opportunity – for accountants, when it comes to accurate financial reporting and tax compliance.

Regulatory progress

The lack of formal oversight is a major challenge, but early this year the FCA published a roadmap for the regulation of the UK’s digital-assets market, intended to establish the UK as a global leader in crypto. HMRC has also released extensive guidance on the tax implications of cryptocurrency. The Scottish government, meanwhile, has set up a consultation on the status of digital assets as property.

Progress is being made in the US and Europe too. The EU’s Markets in Crypto-Assets Regulation was adopted by the European Parliament in April 2023, while the new crypto-friendly US administration promises regulatory clarity to drive growth.

As Dr Max Bernt, Global Head of Regulatory Affairs and Managing Director for Europe at TaxBit, says, “In the past, compliance departments would have prevented institutions joining the space, but with Europe leading regulation, many institutions have decided to join the game. It’s really driven by businesses in the financial sector.”

As with any class of asset, an accountant needs to understand how a crypto-asset is used in the context of the business.

Rob Gaskell, Partner, Appold

‘Continuous education on the underpinning technology, regulatory changes and tax implications is vital’

Which are the most common crypto-assets being used and why?

While tokenised assets are causing a lot of noise in the market, in terms of actual use, stablecoins [cryptocurrencies tied to a fiat currency, typically the US dollar] have proven to be a more practical digital asset for business use currently. The most popular stablecoins are USDT, issued by Tether, and USDC, issued by Circle.

As to the motivation for stablecoin usage, we surmise that this is due to their utility in payments, particularly cross-border payments.

Companies are also increasingly using bitcoin as a currency hedge and store of value. We expect companies to increase their holdings throughout 2025.

How can accountants ensure they account properly for crypto-assets in their processes?

Continuous education on the underpinning technology, regulatory changes and tax implications is vital. Additionally, collaborating with digital-asset specialists is vital to ensure comprehensive and bespoke processes are developed. The accounting rules can be inconsistent across jurisdictions, and CFOs, accountants and auditors need to make the best judgements on consistent treatment of the assets they hold.

How can accountants ensure they audit digital assets correctly?

The high degree of specialist technical knowledge needed to audit these blockchain assets requires the use of external expert assistance to ensure accuracy and integrity. Attempting to undertake a digital-asset audit without substantial in-house or third-party expertise puts the auditor at substantial risk of an over-reliance on the client to guide them through the technical aspects. This risks mismanagement and control deficits going unspotted.

Dan Howarth, Gravita

Dan Howarth, Gravita

As Dan Howarth, Audit and Assurance Partner, Gravita, says, “For example, if the asset is traded as part of the business, then it may be classified as inventory. However, if it is held as a longer-term investment then it would probably sit as an intangible asset.”

He adds that it is important to understand the custody of the asset and whether it is held by the business or on behalf of another party: “This is key to determining whether the asset is held on or off the balance sheet.”

John Beck, Founding Partner at US-based Beck & Beck Missouri Lawyers, says that one effective approach to tracking digital assets is using blockchain analytics tools to verify ownership and transaction histories.

“Digital assets are recorded on decentralised ledgers, meaning accountants can leverage these tools to audit holdings with greater transparency,” he says. “I’ve seen cases where failing to reconcile digital transactions with these tracking tools led to significant tax miscalculations, costing businesses thousands in penalties.”

Reagan Cook, TaxBit

Reagan Cook, TaxBit

Identifying value

US-based Reagan Cook, Accounting Subject Matter Expert at TaxBit, says accountants are also struggling with determining, and proving, a fair market value for crypto-assets. “It’s important to have a clear pricing model for different tokens as the market can deviate significantly.”

Steven Kibbel, a US-based financial planner who has analysed how emerging asset classes impact financial planning, compliance and reporting, says, “If bitcoin’s value drops you can write it down, but if it skyrockets, you can’t write it back up. This creates a distorted picture of a company’s financial position.”

Non-fungible tokens (NFTs) add another layer of complexity because value depends on market demand. As Kibbel says, “For instance, an NFT bought for $100,000 (£81,000) might sell for $10,000 or $1m next month. It’s hard to establish a reliable benchmark.”

He says he’s noticed more firms turning to third-party valuation services for help: “These services use AI-driven platforms or market data to provide real-time valuations. It’s not a perfect solution, but it helps reduce some of the subjectivity involved.”

Cook adds that timestamp pricing is “very significant” for achieving a fair valuation of crypto-assets, providing a precise reference for when a price is recorded.

Amarjit Singh, Assurance Blockchain Leader, EY Europe, Middle East, India and Africa

‘At EY we believe that blockchain and crypto-assets will be the future of financial services’

What is the biggest trend you are seeing as crypto-assets become more popular?

Tokenisation – the digital equivalent of a real-world asset, share or bond – is continuing to grow in popularity.

How can accountants best deal with the grey regulatory area of crypto-assets?

There are guidelines in place advising accountants of what they should be aware of and the criteria they should consider when accounting and auditing digital assets.

Accountants must make sure they are clear about the treatment of crypto-assets, and that they can comply with all the relevant guidelines and regulatory requirements, as well as accounting and auditing requirements accordingly. Of course, the crypto-asset space moves quickly and you can’t prepare for every single eventuality, but accountants will need to use their judgement.

What is your key piece of advice to accountants grappling with accounting and auditing crypto-assets?

It’s crucial that they really understand the crypto-asset in front of them. They shouldn’t assume that just because they know how accounting or auditing works for bitcoin, that it is going to work for ethereum. Similarly, just because they know how to audit and account for one type of tokenised asset, doesn’t mean it will work for another type.

It’s essential they understand the asset in front of them – including the details, the intricacies – as they are all unique. I think we will move to a world where there is some degree of standardisation, but in the meantime there is a lot of experimentation. It’s important not to underestimate the time it will take to understand the products and the auditing and accounting implications.

Is it an exciting time to work in accountancy and auditing?

Yes. At EY we believe that blockchain and crypto-assets will be the future of financial services.

Lots of the big global banks now have crypto or digital-asset subsidiaries, so there is a shift taking place already. As accountants and auditors, we’ve got to move as well in order to be able to support stakeholders.

It’s interesting, challenging but not easy. We’re at the starting blocks of something that has the potential to make a huge change to financial services.

Applying tax to crypto-assets can also be a murky area. In the UK, HMRC considers cryptocurrency to be a capital asset, so whether it is sold, traded or spent, it is typically subject to capital gains tax, while income tax applies to crypto-related earnings such as payments or mining.

One difficulty lies in the fact that cryptocurrency is typically not associated with any single jurisdiction. For example, the bitcoin blockchain is stored on servers globally, so could be deemed to be everywhere – or nowhere.

“The key isn’t just knowing the tax laws – it’s adapting to a system that evolves faster than regulation can keep up”

John Beck, Beck & Beck Missouri Lawyers

Jack Burroughs, TEP, Senior Associate in the Private Wealth and Tax Team, Quastels, says, “There are conflicting legal viewpoints. HMRC has set out a position in guidance, but it doesn’t have a clear legal basis, and in any case doesn’t necessarily cover all situations. For many clients this will have a significant impact on their tax position.” He advises taking specialist legal advice whenever encountering anything unclear.

Poised for auditing

While this is an area that ICAS is keeping a very close eye on, Director of Policy Leadership, James Barbour CA, says there is still much to be done. Current standards allow decisions to be made, but at some stage there will need to be a more comprehensive framework. When it comes to auditing crypto-assets, traditional principles still apply for now.

Reagan Cook adds that being prepared for an audit is critical. “For example, if I export all my income transactions, and the exchange that I’m exporting from assigns a value, I need to have a plan in place to price that lot over time and when it gets disposed of. I need close attention to detail.”

She has seen companies scrambling to pull this information together at the eleventh hour when undergoing an audit. “This can be painful and error prone when done at the last minute in a spreadsheet,” she says.

The challenges of adapting to a fast-paced digital environment where rules are still being made are manifold, but as the world embraces crypto-assets, there is also a big opportunity.

As Beck says, “Digital assets aren’t going away, and the sooner accountants integrate forensic blockchain tools and real-time valuation models into their auditing processes, the fewer disputes they’ll face. The key isn’t just knowing the tax laws – it’s adapting to a system that evolves faster than regulation can keep up.”

For more technical resources visit our audit hub

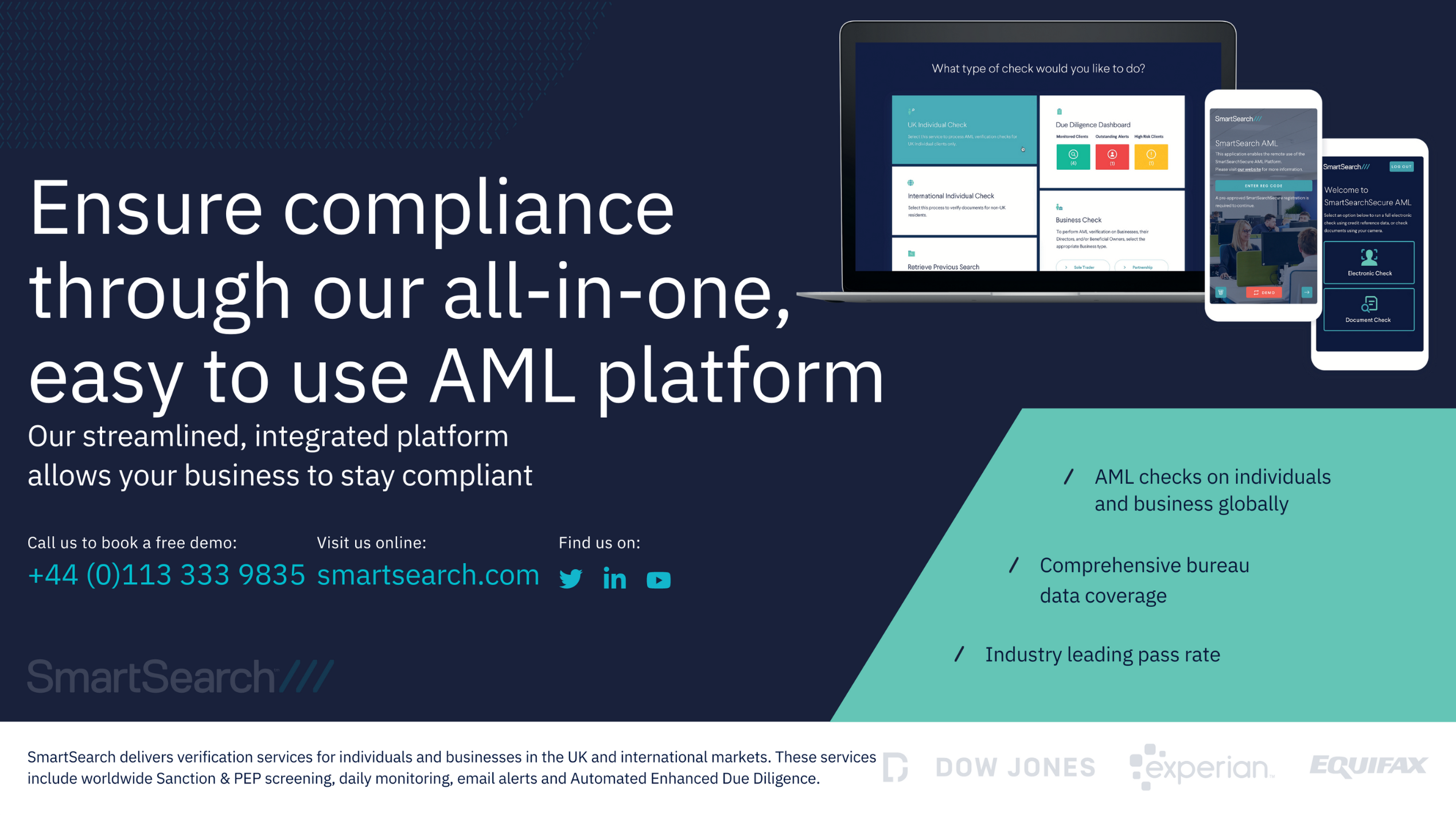

ADVERTISEMENT