Seeds of success

As Deputy Chief Investment Officer, Ian Connatty CA is at the heart of the British Business Bank’s efforts to back the great enterprises of the future. But can he reverse the trend of the UK birthing brilliant start-ups, only to see them move abroad? Dominic Bliss finds out

Before he started his ICAS training in September 2000, Ian Connatty had “no idea whatsoever” of the career he wanted in life. “Literally none,” he says. “I did an internship at EY and they were offering the ICAS qualification. I just fell into the training. But it was amazing for me. It really helped me understand the world of business. I remain incredibly glad I went down that road.”

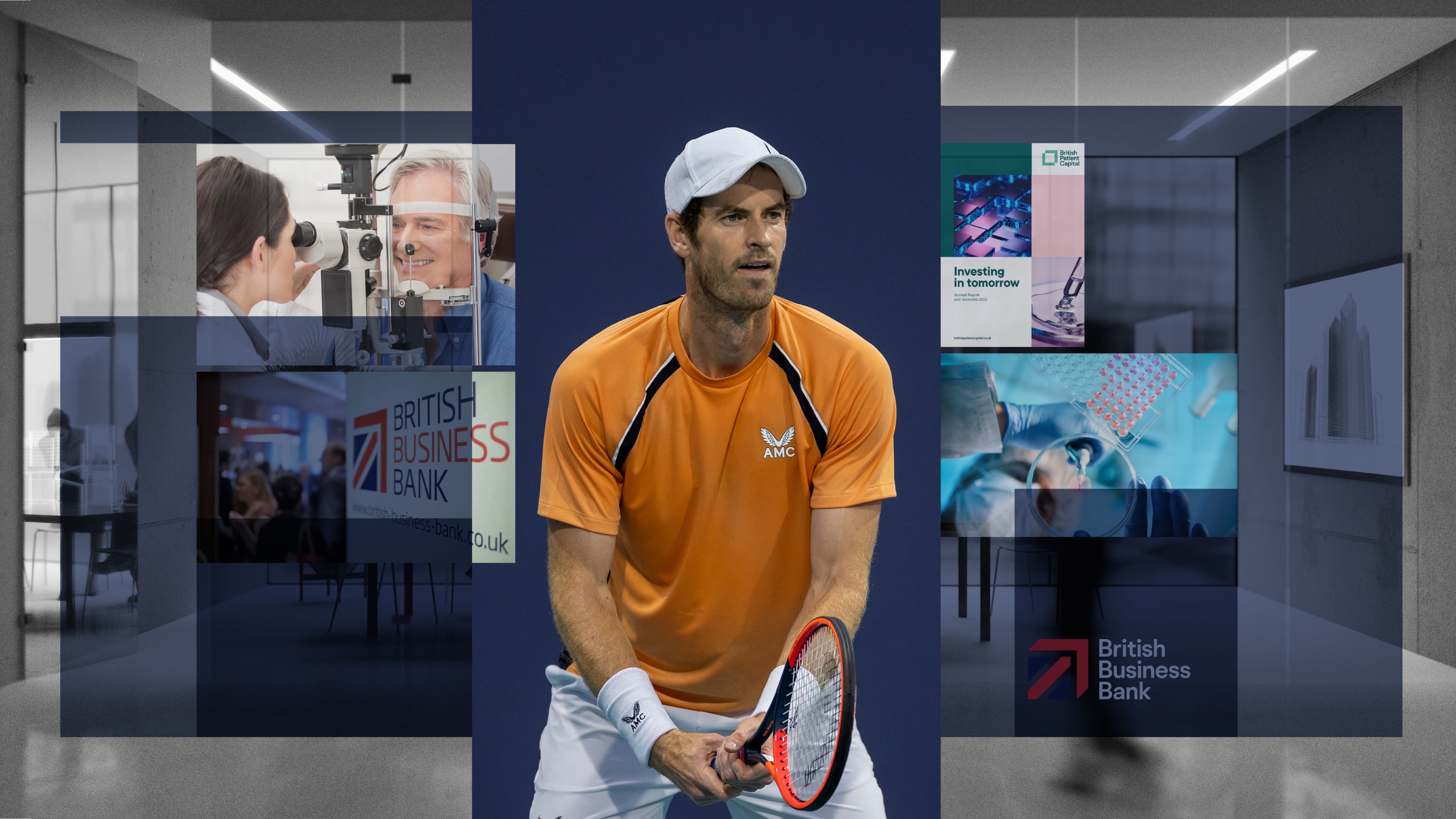

Nearly a quarter of a century later, Ian Connatty CA is now Deputy Chief Investment Officer at the British Business Bank, the government-owned economic development bank. This is in addition to his role as Managing Director, Direct and Co-investment, at British Patient Capital (BPC), a commercial subsidiary of the same bank. The roles have Connatty overseeing investment in small and medium-sized British start-ups through both direct and co-investment. The bank’s core programmes have delivered over £12.4bn of finance to more than 90,000 smaller businesses. In March, it launched the second edition of its Northern Powerhouse Investment Fund, which should provide £660m to SMEs in the region.

“In the UK we’re good at starting companies but not so good at scaling them up,” he explains. “We would like to see more home-grown, fully-funded champions.” BPC was launched in 2018, specifically to provide access to long-term finance – or “patient capital” as it’s known.

The sectors Connatty and his team are particularly keen to develop are life sciences and deep tech (high-tech innovation in science or engineering). They have already helped a host of innovative companies across the UK. In London, there is Quell Therapeutics (developers of cell therapy), Tenpoint Therapeutics (ocular therapy) and Quantum Motion (quantum computing). In Sheffield there is Iceotope, which creates immersion cooling for IT infrastructure. Cambridge has Pragmatic, a semi-conductor manufacturer, while Oxford has health technology company Perspectum.

“The mission is about building independent businesses of scale that can go on to be global category leaders,” Connatty stresses. “Clearly not all companies we invest in are going to make it but that’s the way venture [capital] works.”

People power

Although not himself trained in life sciences – he studied economics at the University of Cambridge – Connatty clearly has a knack for spotting emerging talent in this sector. As with the TV show, Dragons’ Den, in which start-ups pitch to wealthy investors, Connatty and his team of experts know there are two key factors in pinpointing a good investment: firstly it must be an innovative idea; secondly, and just as crucially, this idea must be backed up by a great team.

“Probably more than any other asset class, this is a real people business,” he adds. “People make a real difference. Start-up companies need a sound, defined, really thoughtful strategy, with a team which knows how to execute it, with a real passion for it.”

Unlike on Dragons’ Den, where the founders typically leap at any investor offers they receive, investors have to work hard to persuade their targeted start-ups that they are the right investor for them.

“Very often, great companies have more offers for finance than they need, so they have to choose to work with you,” he explains. “That personal connection is vital, [as is] the sense that you can make a difference to the outcome.”

Inevitably, not all the companies Connatty invests in go on to succeed. “It’s hard, and there are bumps in the road, so you’ve got to know you can work with [the companies] when things are good, when things are indifferent and when things are tough. That’s why that personal element is so important.”

While there is no lack of British talent in life sciences, Connatty admits it’s a sector the nation’s business world struggles to commercialise. That’s partly because it is so technical; complex even. Of the global total of approximately 1,200 unicorn companies – that’s start-ups that have grown to a valuation of $1bn-plus (£790m) – the lion’s share are based in the United States. China is the next most fruitful nursery, followed by India. In fourth place is the UK. According to business analysts CB Insights, in 2022 there were 46 unicorns in the UK, most of them in technology and software.

“It’s that chicken-and-egg issue,” says Connatty. “Once you have the investment and a company shows visible indications of success, then success begets success. Companies then scale up. There are a lot of people involved on that journey, and then people spin off and start the next generation of companies. That, in turn, creates wealth that people invest back into the ecosystem. It’s what you need to take a company from a bench in a lab all the way through to an initial public offering. We’re trying to be the catalyst in that process.”

Connatty points to other start-up companies that have grown to become unicorns thanks to BPC investment. There’s data and analytics specialist Quantexa, for example, which helps users solve challenges in data management, customer intelligence, financial crime, credit risk and fraud. Founded in 2016, the company now employs more than 675 people in 14 offices worldwide and is valued at $1.8bn.

Then there’s banking software company Thought Machine, which has now opened offices in New York and Singapore and has more than 500 employees worldwide. Also flourishing are bank payment company GoCardless, personal finance platform Lendable and payment infrastructure provider Paddle.

Perhaps the best-known beneficiary of the bank’s support is not a fintech firm, or even one in the broader tech sector; it’s the sportswear brand Castore, which makes the shirts for Rangers, Andy Murray and the West Indies cricket team.

Limited partner

Connatty’s own career has followed a similarly upward path. After qualifying with EY, he moved to Royal Bank of Scotland, working in financial modelling. Then came invaluable experience at a technology start-up, Infinity SDC, as Corporate Finance Manager.

In 2009, he joined the British Business Bank’s predecessor, Capital for Enterprise Limited, where he formed part of the team that set up the bank. “If I’m entirely honest, I’m not sure I knew what being a limited partner was,” he recalls of the move. “But it sounded interesting. Fifteen years later, here I still am. It’s because of the passion and energy I get from what I do.”

In December last year, he was made the bank’s first Deputy Chief Investment Officer. Eventually he will report to the Chief Investment Officer once that role has been filled later this year.

Education

Studied economics at University of Cambridge

2000

Trains with EY, qualifying in 2004

2004

Moves to Royal Bank of Scotland as Manager/Associate Director

2007

Works at tech start-up Infinity SDC as Corporate Finance Manager

2009

Joins Capital for Enterprise Limited, forerunner of the British Business Bank

2018

Helps set up British Patient Capital, a British Business Bank subsidiary

The bank has two offices – one in the City of London, the other in Sheffield. Connatty spends his time between the two, with occasional days spent working from home in Scunthorpe, where he lives with his wife and three children – two boys and one girl.

Family, he says, takes up much of his free time. Otherwise, he loves running and football, coaching his son’s youth team in the latter. He is also an amateur writer, especially of film and TV scripts, although he admits success in this field has so far eluded him.

But what will the future bring for the British Business Bank? Labour has talked of renaming it the British Regional Investment Bank and encouraging the bank to switch its focus away from London. Meanwhile, the London Stock Exchange has been struggling since Brexit, with some UK firms moving abroad and IPOs in short supply. Connatty won’t be drawn on whether a change of government will mean a change for the bank. He knows any enterprise comes with its share of setbacks, but he is driven by seeing the start-ups he invests in flourish.

“It’s what keeps me doing what I do and it’s why I absolutely love it,” he says. “But the thing that is most rewarding is that it’s not success all the way. There are moments of adversity. Working with people to overcome that and seeing how they get through to the other side is genuinely inspirational. It’s inspiring to see how entrepreneurs work hard, show passion, overcome obstacles and get there in the end.”

Many start-ups find themselves disrupting existing industries, he explains, and must be resilient in the face of rejection: “You will get a lot of noes along the way. That resilience and pluckiness, and the ability to make it work, is a compelling narrative.”

For more about public investment, read our feature on Euan Baxter CA of BGF

ADVERTISMENT