Arabian adventures

Suzy Kerton CA, CEO at Zyla Accountants, came to Dubai to visit her sister and ended up building her life and business here. Rachel Ingram hears about life and work in the Arabian metropolis

Arabian adventures

Suzy Kerton CA, CEO at Zyla Accountants, came to Dubai to visit her sister and ended up building her life and business here. Rachel Ingram hears about life and work in the Arabian metropolis

They say the best things in life happen when you least expect them – and that was certainly true for Suzy Kerton CA. A holiday to Dubai in 2020 turned into an unexpected relocation that changed everything. Now CEO of Zyla Accountants, Kerton has transformed a spontaneous decision into a thriving international business, with teams in the UK, UAE and Sri Lanka.

Travel has long been a part of Kerton’s career, which has taken her from Buckinghamshire to the UAE, via Spain, Argentina and London. A member of ICAS Council and its Dubai ambassador, she shares her journey of life and work in the city emirate – and reveals why, with its entrepreneurial spirit, digital focus and welcoming business climate, now is an excellent time to build a business in Dubai.

Ifeel like I was always meant to be here in Dubai. When I first came, I thought, “Wow, that’s the place I want to be”, but I never connected that I could start a business and stay here – but I suppose it found me somehow.

I’ve always liked the idea of living abroad. I studied economics and Spanish at Nottingham University and had the opportunity to spend a year in Spain. I then went to Baker Tilly on a training contract. I didn’t always want to be an accountant, but I thought it was a great qualification to have if you want to go into business, and I really like numbers, so it was a natural thing to do. I was in audit for about four years and again, I went on secondment – this time to Buenos Aires in Argentina.

When I came back to London, I started a job as CFO of Clear Books, which introduced me to the cloud accounting concept. I saw a whole new world of small businesses running their accounts themselves on software. I could see that was a great opportunity to get involved with, as it has a really big impact for smaller businesses.

I started Zyla as a side hustle while doing an MBA at Imperial College. I didn’t actually start it as an accounting firm. Originally, I wanted to arrange secondments for accountants – like I’d done myself – but it proved too hard because of the visa situation in the UK. So that died a quick death and I shifted my focus to bookkeeping.

“It is easy to do business in the UAE.

They really welcome entrepreneurs, and they want people to live and do business here”

While studying at Imperial, I met a lot of entrepreneurs and start-up owners who became my first clients – some of whom are still clients with us now. We had an office in Kensington, but when Covid hit, we went fully remote as we realised it didn’t matter where we were.

In 2020, I went on holiday to the UAE to visit my sister who lived in Dubai. I’d been to the city once before on the way to India for a wedding, and I had a nice vibe from the place. People were friendly and it seemed really safe. It wasn’t in my plans to move there, but I stayed.

Time has flown since then. I met my husband here in 2021, got married in 2022 and had a baby in 2023. He also works in Zyla; he’s Lebanese, so he speaks Arabic, which is a great support. Zyla is quite international now. We’re a team of eight in the UK, three in Dubai and three in Sri Lanka.

The UK has been very difficult for the last few years and there’s not a lot of growth, whereas Dubai is the opposite. They really welcome entrepreneurs, and they want people to live and do business here. Obviously, there’s a corporate tax of 9% if your business makes more than 1m AED (£250,000), but in the UK, as a small business owner, you’re taxed left, right and centre. The banking system is good here, too, and it’s easy to get set up – most things are digital. They also have the “Free Zone” concept – we’re an IFZA [International Free Zone Authority] company, which has certain tax advantages, and we have an office in a business park where it’s all set up so it’s easy to establish yourself. There’s a strong focus here on being digital and trying to be at the forefront of crypto and AI – Dubai has invested a lot in that.

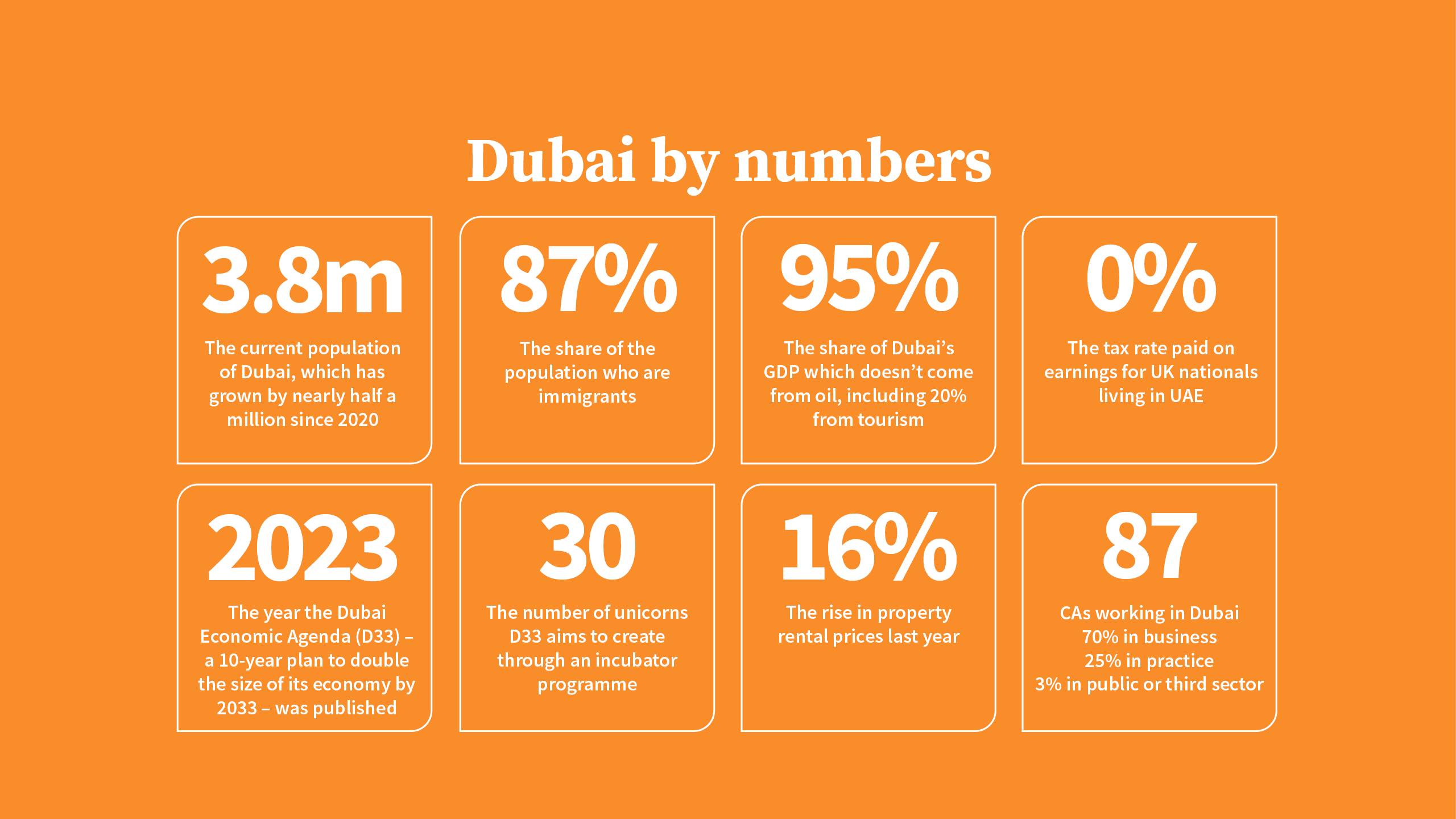

One thing that I love about Dubai is that if they’re going to do something, they just do it. We went away for the summer and when we came back, they’d built a new road and a new bridge. Imagine that bridge was in the UK – it would have taken five years. One negative is the traffic is a bit ridiculous, because there are so many people now – the population has more than doubled since 2010 and stands just short of four million, the vast majority of whom are immigrants.

Before I moved to Dubai, I didn’t have many expectations. I’d heard some negativity about it being very strict and restrictive, but I find it’s an easier lifestyle than in the UK.

There’s always something going on in the UAE. They have amazing events. I love tennis, and they host big tournaments with all the top players and yet they’re never too crowded. It’s similar in Abu Dhabi, where I saw Michael McIntyre perform recently. Dubai has started a basketball team and I’ve been to watch it in the Coca-Cola Arena a few times.

It’s quite an outdoorsy lifestyle. We go to the beach a lot in the mornings, before it gets too hot, which is amazing to be able to do. We go for a coffee and sit outside at the Els Club or the polo club in Studio City. I’m very into padel tennis, too – we had a padel social a few weeks ago with the ICAS Dubai network.

It’s an amazing experience if you can find a role abroad. Pushing yourself out of your comfort zone makes you grow as a person and learn so much. I wouldn’t recommend coming to the UAE without a job because that can be a very difficult journey and you don’t want to put that pressure on yourself in a new country – especially in the UAE, which is not the cheapest of places to live.

But CAs are very sought-after internationally and ICAS is recognised here. You can also continue adding qualifications to your résumé. Last summer I became an FTA-registered [Federal Tax Authority] tax agent in VAT, and this year in corporate tax – one of the first ICAS members to do so – having studied in PwC’s training academy out here.

My tip for anyone thinking of moving abroad is to get in touch with ICAS and they can connect them to the local area network. As a network, we meet around three times a year, but if anyone reaches out I can add them to our network, which includes people from all the Big Four, and they can put people in touch for recommendations of work. I’d also recommend coming on holiday before you move. You never know, you may just end up staying.

Learn more about working in the UAE