The Master of Disaster

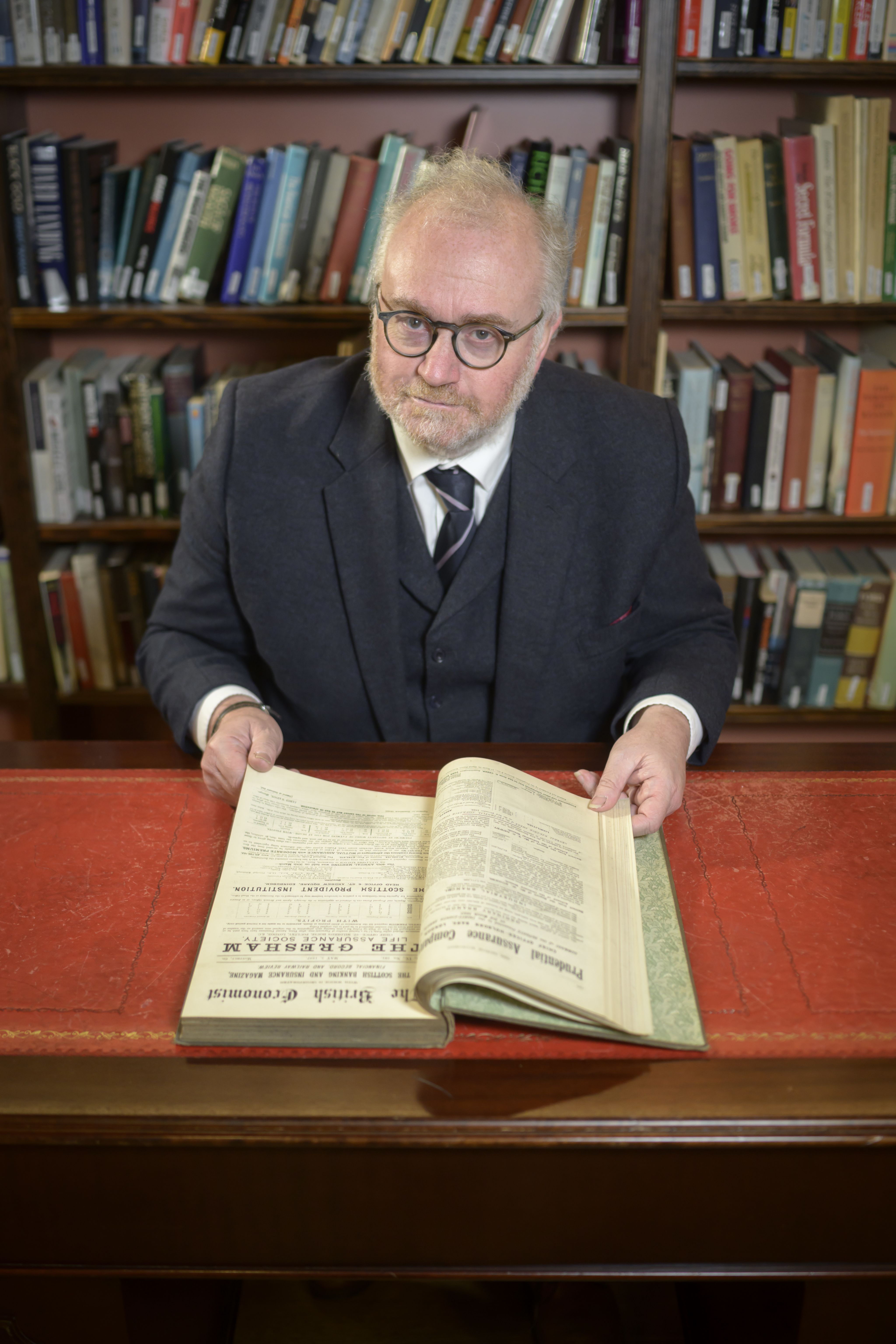

Professor Russell Napier, founder of the Library of Mistakes, is on a mission to ensure the financial world learns from the failures of the past. Fraser Allen meets him in his campaign headquarters

PHOTOGRAPHY AND VIDEO: JOHN LINTON

Tucked away in an Edinburgh mews is a beautiful building housing a strange project called the Library of Mistakes. After ducking out of the city’s busy West End onto the cobbles of Melville Street Lane, a visitor will see the library’s presence announced by a statement attributed to Albert Einstein. Painted in big red letters on the white exterior, it reads: “The only thing that you absolutely have to know is the location of the library.”

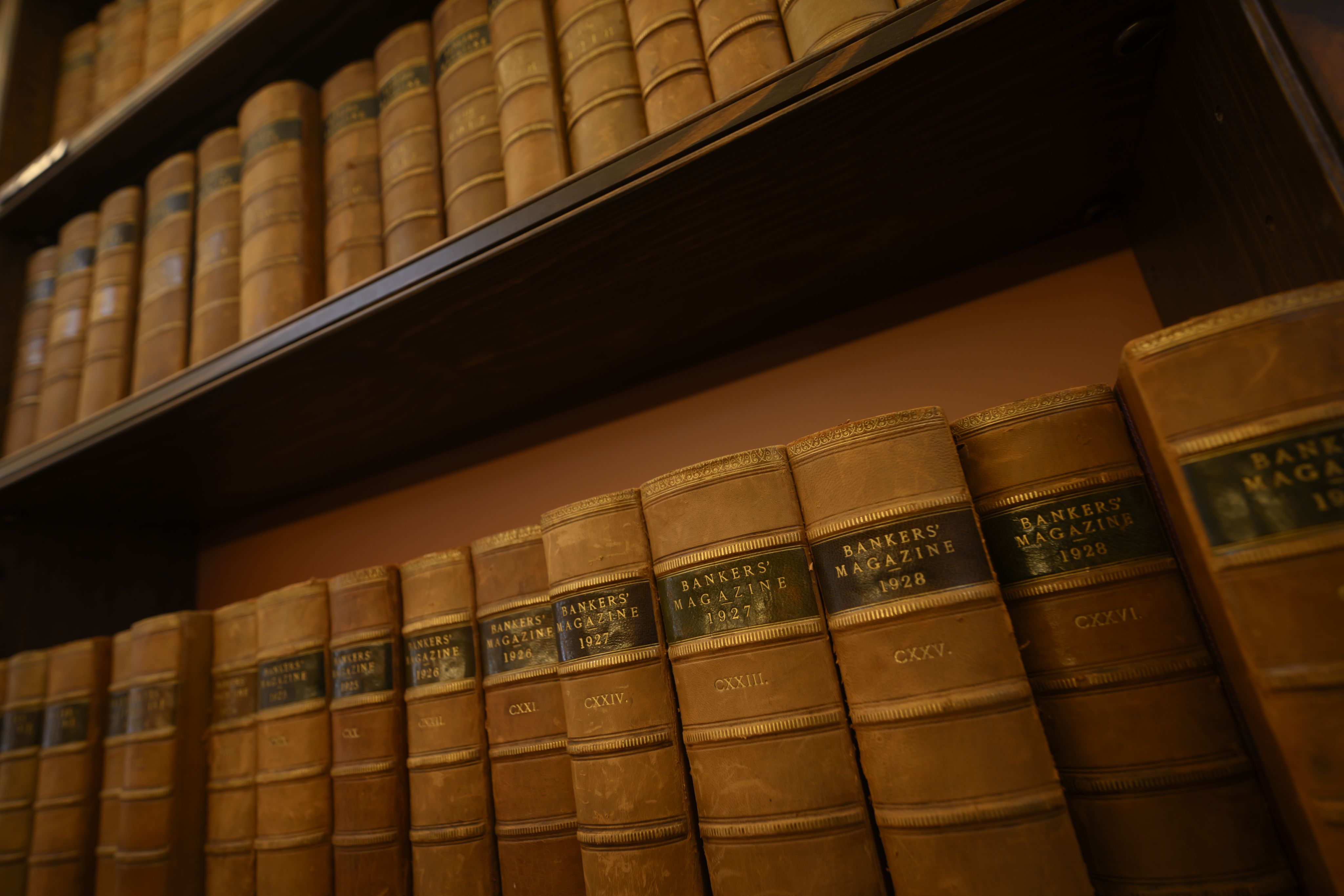

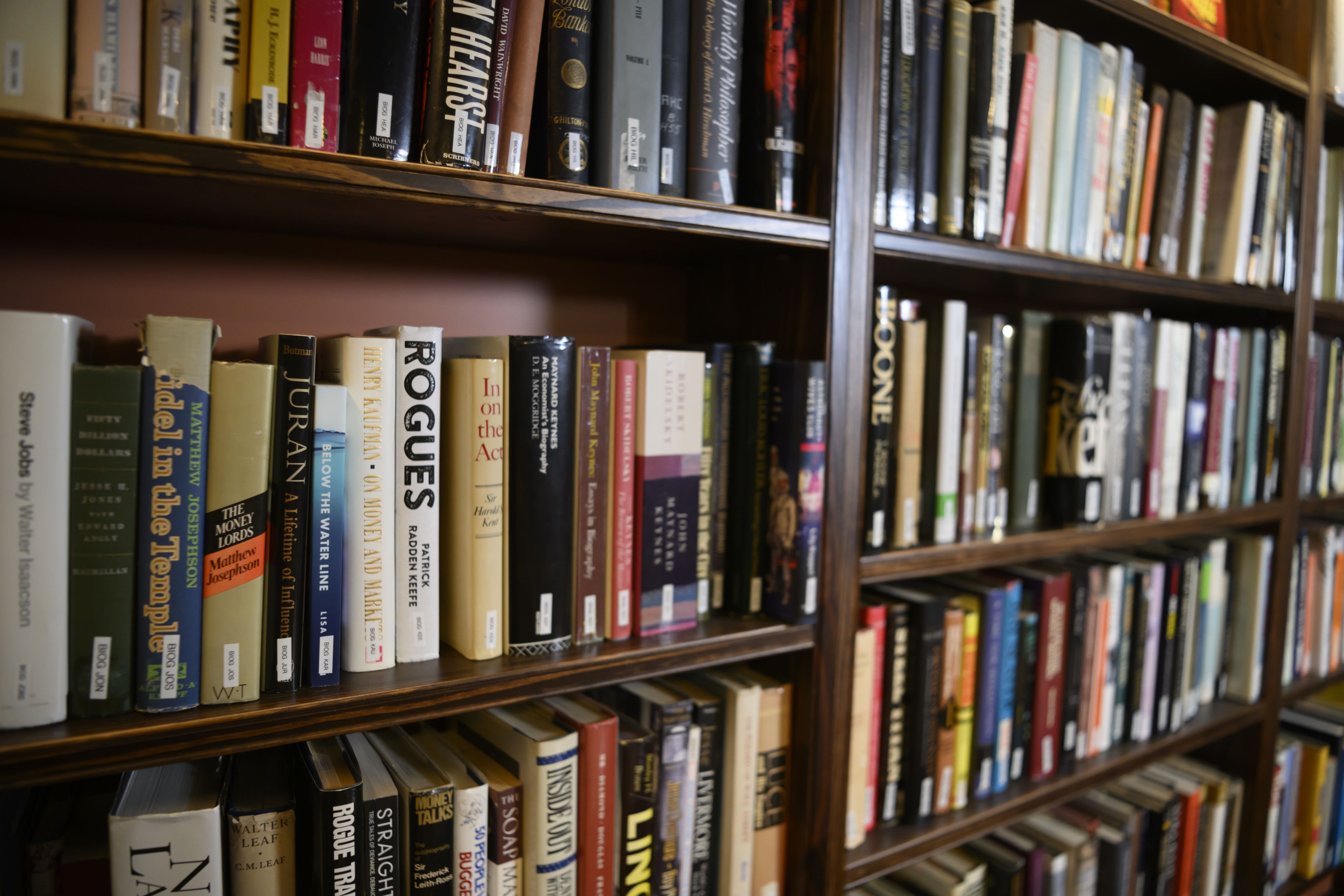

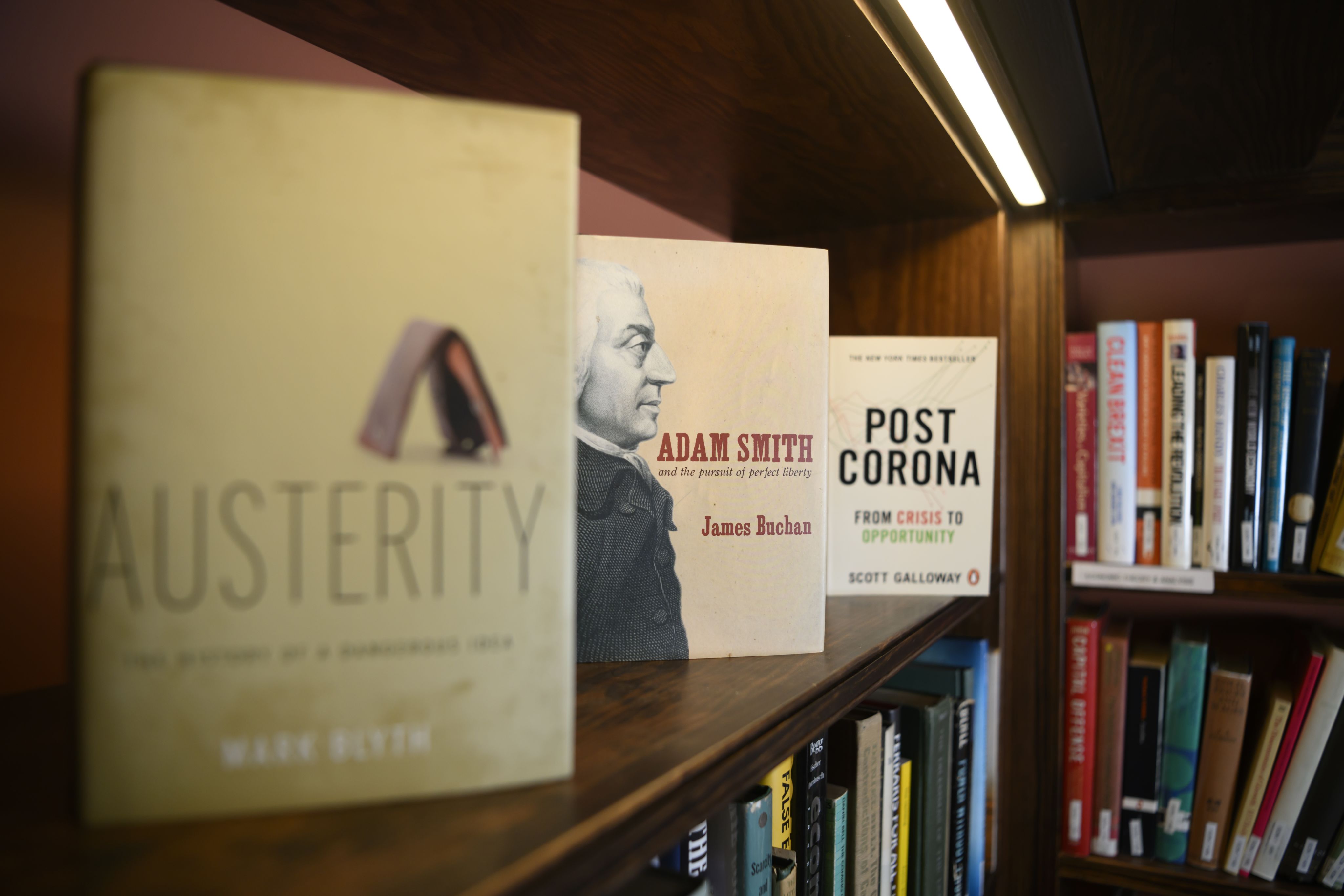

Entering this library feels like stumbling across a well-kept secret (full disclosure: the author of this piece curates the Library of Mistakes’ social media and produces its eponymous podcast). Fitted out with wood panelling, spiral staircases and plush armchairs, the elegantly designed space is home to around 4,000 books documenting errors made in business and finance – failures from all over the world, spanning the centuries. The majority of the books, however, focus on financial collapse and scandal in the US and UK over the past 120 years. Scoundrels such as Bernie Madoff, Ernest Saunders and Sam Bankman-Fried peer down from the bookshelves (it’s worth noting that nearly all the villains and blunderers featured in the collection are men).

The library also displays numerous artworks and mementoes reinforcing the theme of “errorism”. For instance, there’s a framed photograph of eponymous schemer Charles Ponzi, a captain’s cap from Laker Airways and a sports shirt signed by Nick Leeson, formerly of Barings Bank. Until recently, there was also an empty can of Bankman-Fried’s FTX-branded beer – unfortunately the cleaners threw it out, assuming it to be rubbish.

Also there, standing before me, is the man behind this adventure – Professor Russell Napier. A butcher’s son from Northern Ireland, Napier studied law at Queen’s University in Belfast, following it with a master’s at Cambridge. Yet instead of a legal career, Napier opted for finance. After taking a job as an investment manager at Baillie Gifford in Edinburgh, he moved into investment research. This led him to write Anatomy of the Bear: Lessons from Wall Street’s four great bottoms, published in 2005.

When people began to notice the lessons laid out in Napier’s book had been comprehensively overlooked by many of the organisations involved in the global banking crisis of 2008, he found a growing demand for his services. By then, Napier had already decided to forge an independent career as an adviser, NED and champion of financial history.

Education

Studied law at Queen’s University, Belfast, followed by a master’s at Cambridge

1989

Joins Baillie Gifford as Investment Manager

1995

Moves to CLSA as Asian Equity Strategist, then as Consultant

2014

Founds the Library of Mistakes; co-founds ERIC (Electronic Research Interchange)

“Best Practices is a collection of lessons Arthur Andersen claimed to have learnt from its smartest clients. There are lots of shining examples of Enron in there – how rapidly that perception would shift”

Life lessons

The idea for the library came when, in the aftermath of the crash, Napier noticed too many people in the financial sector were continuing to repeat the same mistakes. It was as if the crisis had never happened.

“The purpose of the Library of Mistakes is to foster the study and understanding of business and financial history,” says Napier. “You might think that’s not very ambitious but, having been involved in finance for 30 years, it’s obvious to me that there’s a lack of understanding of history. People are surprised when things go wrong, and oblivious to the fact that these mistakes have been made over and over again, and yet we never seem to learn from them. The library helps us to bring those lessons to life.”

Originally founded in 2014, and opened in Wemyss Place Mews by former Chancellor Norman Lamont, the first Library of Mistakes was every bit as charming as the current building but much smaller, and split into three rooms – making it impractical for events. The new library, inside an old girl-guide hall, was purpose-built for events and was opened in spring 2022 by another former Chancellor, the late Alistair Darling (who, of course, had a front-row seat during the crash).

Most visitors to the library have a professional interest in finance, but which books would Napier point a curious CA towards? “The most important story from an accountancy perspective is probably Enron,” he says. “After all, its downfall destroyed the auditors Arthur Andersen, one of the world’s biggest accountancy firms.

“We have several books about the Enron scandal, plus more than 20 boxes of materials on the case, donated by Professor Stewart Hamilton, who was an expert on the subject. We also have a book put together by Arthur Andersen, called Best Practices, published not long before Enron collapsed. The book is a collection of lessons that Arthur Andersen claimed to have learnt from its smartest clients. As you can probably guess, there are lots of shining examples of Enron in there – how rapidly that perception would shift.

“Clearly none of the mistakes you’ll find in the books here are solely caused by accountants. But prior to every corporate collapse and scandal documented in the library, there will have been audited statements signed off.

“Wirecard is a particularly interesting example of such failures because it was fraud on the part of the client – the accountants and the auditors were misled. Reading Money Men by Dan McCrum reveals why you should keep asking the right questions, and what the wrong answers to those questions might be. Another good example is the history of Abraaj, which is covered in a book called The Key Man by Simon Clark and Will Louch. It focuses again on how a determined CEO or CIO can pull the wool over the eyes of an accountancy firm. It’s a useful guide to some of the red flags to look out for when fraudulent information is being passed on.”

Naming right

Napier may be a financial man, but he has read enough books to also understand the power of branding. “Calling this place something like the Edinburgh Business and Financial History Library was unlikely to give us much traction,” he admits. “The Library of Mistakes name popped into my head while I was driving across the A9 bridge at Loch Faskally. Don’t ask me where it came from because I don’t know.”

Both iterations of the library were funded largely through donations from Edinburgh’s financial community, both individuals and firms. Another important source of revenue is a course – A Practical History of Financial Markets – that Napier has been running since 2004. (Featuring a distinguished roll-call of experts, the course can be accessed online or in-person in London and Edinburgh.)

The library is free to visit, by appointment, and regularly stages lectures from authors which, for those unable to make it to Edinburgh, can be seen on its YouTube channel. There is also a podcast series, hosted by Napier. Yet another former Chancellor, Kwasi Kwarteng, was a recent visitor, reflecting on his book, War and Gold, his 38 days at 11 Downing Street and his ill-fated “fiscal statement”.

There are global ambitions for the library. Napier has already forged partnerships that have seen a Library of Mistakes – same brand, same ethos, similar catalogue of books – established in both Pune, India, and Lausanne, on Lake Geneva. Furthermore, a memorandum of understanding was recently signed for Singapore, and active discussions are under way in London, Amsterdam and Sydney.

Napier’s ultimate hope is that the library’s growing profile persuades leading academic institutions to bring history back into the mix with finance and business education. Until then, there is little to stem the relentless tide of blunders – such as the accumulation of excessive debt. “Some countries, such as Japan, China and France, now have the highest levels of debt relative to GDP they’ve ever had in peacetime,” says Napier.

“So how do we solve that? In democracies, the solution usually lies in growing GDP and cashflows in nominal terms, which means higher inflation. But that’s not going to be a straight path to solving excessive debt. That’s the problem – and the mistake has been having an incentive structure in place (taxation etc) that rewards us for too much debt.”

So what does this keen student of other people’s mistakes consider to be his own biggest professional blunders? “Not being optimistic enough,” he says, without hesitation. “Having written the book on the four great bottoms, I found it harder to enjoy the excesses of the market.

“To put that right, I have a thing I call Pepper’s Law, which is a saying invented by a man called Gordon Pepper, who was a monetary adviser to Margaret Thatcher. He said that when you see something going on in the markets that you think is excessive, something that just can’t continue, work out the longest period you think it can last, then double it and then take off a month. So I’m trying to cure my pessimism by using Pepper’s Law to enjoy some of the parties, while hopefully leaving just before it’s time for the hangover.”

Read CA magazine’s interview with Martin Wolf

Want to visit?

The Library of Mistakes is a free, public library. To visit, go to libraryofmistakes.com, register as a reader and request a day and time to visit. Admission at the appointed hour is via remote access. Signing up also means you’ll be notified of lectures to be held at the library. Again, these are free (and available on the YouTube channel, youtube.com/@LibraryofMistakes), but donations are welcome. The Library of Mistakes podcast, hosted by Russell Napier, is available on all the usual platforms.